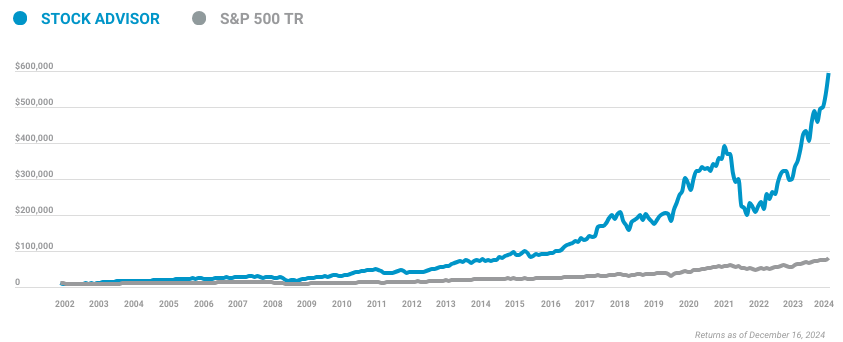

Wake up to the latest market news, company insights, and a bit of Foolish fun—all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 AM ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

| Thursday's Markets | |

|---|---|

| S&P 500 5,869 (-0.22%) |

|

| Nasdaq 19,281 (-0.16%) |

|

| Dow 42,392 (-0.36%) |

|

| Bitcoin 97,022 (+2.31%) |

|

President Biden has decided to block the proposed $14.9 billion U.S. Steel (NYSE:X) takeover by Nippon Steel, according to unnamed officials. Confirmation either way is expected within the coming days.

- Referred to the top: Biden had previously expressed concern the company should remain American owned and operated, with the decision referred to him after the regulators failed to come to a consensus view.

- Back to the drawing board: Investors had already become somewhat skeptical about the deal, given the stock price closed Thursday just below $33, a long way off the $55 offer price. Should the deal be blocked, it raises more questions for U.S. Steel about whether or not to restart the sale process domestically.

Rigetti Computing (NASDAQ:RGTI) jumped 31% on the first trading day of the year as interest in quantum-related stocks picked up from where it left off in late 2024.

- Rigetti stock up 386% in just one month: Quantum computing focuses on using sophisticated mechanics to solve complex problems beyond the capabilities of normal computers. Interest in this area has soared after longtime Rule Breakers rec Alphabet (NASDAQ:GOOG) revealed its new Willow computing chip in early December. Investors are now targeting the likes of Rigetti, which builds quantum computers.

- “We are going to all get a little more familiar with the terms that surround this discipline”: In a recent episode of Motley Fool Money, Asit Sharma’s reckless prediction was for quantum computing investing to go mainstream in 2025: “I think you'll see people start to take some nibbles at some stocks that admittedly already look like they're in a bubble.”

Short seller Hindenburg Research caught investor attention following the release of a report making accusations about Carvana (NYSE:CVNA).

- “A father-son accounting grift for the ages”: The title of the report packs a punch, with the details showing why Hindenburg believes the business performance is a mirage. It believes shady car underwriting practices between family members is a major reason for concern.

- Down over 6% ahead of the market opening: Investors will be awaiting some form of statement from Carvana addressing the claims, as historically Hindenburg reports have the potential to cause large reputational damage.

Despite posting a record number of car sales in the final quarter, Tesla (NASDAQ:TSLA) saw annual vehicle deliveries fall for the first time in more than a decade.

- Stock down 6% on the news: Q4 deliveries of 495,570 fell short of analyst estimates of 510,400. The bulk of deliveries for 2024 was for entry-level models, such as the Model 3 and Y.

- Broader implications: Investors might have some concern this signals some growth slowdown in the electric vehicle market. Despite the 18% drop in the last five trading days, the Hidden Gems recommendation is still up 59% over the past year.

What business that has previously been spun off into a separately traded company do you have most conviction in for the long term, and why? Debate with friends and family, or become a member to hear what your fellow Fools are saying!