The "Magnificent Seven" describes the seven biggest technology-focused companies that have led the market's returns in recent years. Bank of America (BAC 1.32%) analyst Michael Hartnett coined the phrase based on the Western film with the same name (originally made in 1960 and remade in 2016).

This update on the term FAANG stocks encompasses more of the top companies capitalizing on technology megatrends. Here's a look at the Magnificent Seven stocks and whether they are good investments right now.

What are they?

What are the Magnificent Seven stocks?

The Magnificent Seven stocks are seven of the largest technology-focused companies by market cap.

| Magnificent Seven Stocks | Ticker | Sector | Market Cap |

|---|---|---|---|

| Apple | (NASDAQ:AAPL) | Technology | $3.6 trillion |

| Amazon | (NASDAQ:AMZN) | Consumer discretionary | $2.0 trillion |

|

Alphabet (Google) |

(NASDAQ:GOOG)(NASDAQ:GOOGL) | Technology | $2.3 trillion |

| Meta Platforms (Facebook) | (NASDAQ:META) | Technology | $1.3 trillion |

| Microsoft | (NASDAQ:MSFT) | Technology | $3.4 trillion |

| Nvidia | (NASDAQ:NVDA) | Technology | $3.2 trillion |

| Tesla | (NASDAQ:TSLA) | Consumer discretionary | $808.1 billion |

All seven companies are focused on capitalizing on large technology-driven growth trends. But technically speaking, five are tech stocks, and two are tech-focused consumer discretionary stocks.

They're leaders in the fields of artificial intelligence (AI), cloud computing, video games, social media, digital advertising, software, hardware, e-commerce, and electric vehicles (EVs). These technology trends are driving outsize growth for companies focused on them.

Should I invest?

Should I invest in the Magnificent Seven?

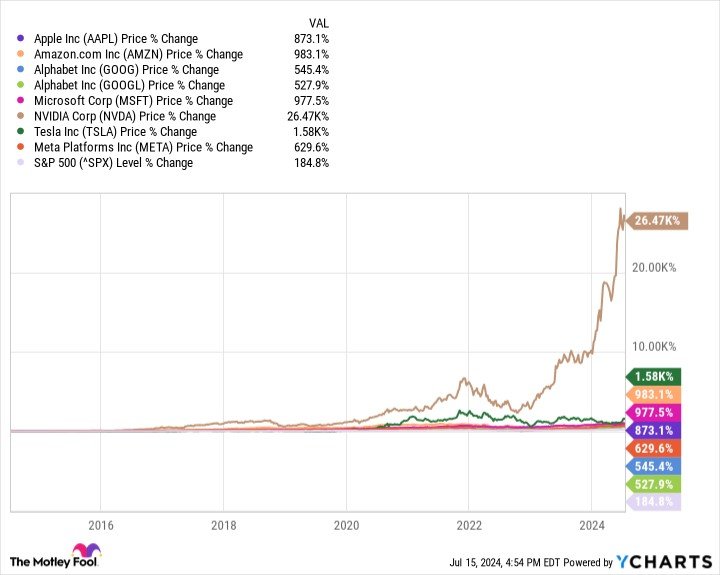

The Magnificent Seven stocks have delivered magnificent returns. As of mid-2024, the group has delivered an average return of 57% over the past year.

That was more than double the return of the S&P 500 (25%). Without the Magnificent Seven, which comprise 31% of the S&P 500 index by weight, the index wouldn't have delivered such a strong return. The Magnificent Seven's strong showing in 2024 continued their dominance over the past decade.

Many investors believe this group of mega-cap stocks can continue producing dominant returns. They're capitalizing on several technology megatrends that should enable them to continue growing at outsize rates. For example, many businesses are still in the early stages of digital transformation (bringing their business processes into the cloud).

This trend could drive growing demand for cloud services for years, benefitting cloud titans Microsoft, Alphabet, and Amazon. Meanwhile, consumers continue to embrace technology, driving demand for tech-driven consumer products and services, like Apple's iPhones, Microsoft's Xbox, Amazon's e-commerce store, and Tesla's EVs.

Those consumer trends are also shifting more ad dollars online, benefitting Meta, Microsoft, and Alphabet. Finally, AI is still in the very early stages of what could be an extraordinary growth cycle, providing a boost to Nvidia, Microsoft, and Alphabet.

Given the Magnificent Seven's still-untapped growth potential, investors should consider adding one or more of them to their portfolios. An alternative way to invest in stocks like the Magnificent Seven is to buy an exchange-traded fund (ETF) with meaningful exposure to those tech titans.

For example, The Roundhill Magnificent Seven ETF (MAGS 2.02%) focuses solely on investing in the Magnificent Seven. Alternatively, the Invesco QQQ (QQQ 1.15%) focuses on the tech-heavy Nasdaq-100. The Magnificent Seven were all among its top 10 holdings in mid-2024 and totaled almost 40% of its total assets.

Asset

Risks

Risks of investing in the Magnificent Seven

Although the Magnificent Seven are among the world's largest and financially strongest companies, they're not without risk. One of the biggest risks of investing in these stocks is their high valuations.

After their market-smashing returns in 2023, the group traded at a premium price. In late 2023, the Magnificent Seven traded at an average price-to-earnings (P/E) ratio above 50 times -- more than double the S&P 500's P/E ratio (slightly over 20 times) and almost twice the tech-heavy Nasdaq 100 (around 28 times).

That's a hefty premium to pay for companies as large as the Magnificent Seven. It could be hard for those already large companies to grow into their valuations in the future, potentially causing their stock prices to underperform.

Another risk is that tech spending tends to be cyclical. If there's a recession and economic growth slows, it could significantly affect the growth of the Magnificent Seven. Given their premium price tags, a recession-driven slowdown could cause a steep decline in their stock prices.

A longer-term risk is that they might struggle to grow at above-average rates because of the law of large numbers. Given their mammoth sizes, it will likely be challenging for the Magnificent Seven to deliver sustained above-average growth in the years ahead unless a new tech trend emerges that accelerates their growth (like AI). If growth slows, it could take some of the premium out of their share prices.

Given their large sizes, Magnificent Seven companies could also face growth challenges due to potential antitrust concerns. Governments might reject future acquisitions they attempt -- much like Microsoft's long road to acquire Activision and Nvidia's blocked deal for Arm Holdings (ARM 4.49%).

If regulators block future deals, it could slow the companies' growth. Meanwhile, due to antitrust concerns, the federal government could eventually force some of the Magnificent Seven to break up.

Related investing topics

The bottom line on the Magnificent Seven

The Magnificent Seven stocks have delivered magnificent returns over the years. These tech-focused companies have capitalized on many of the biggest technological growth trends, enabling them to grow rapidly and produce strong returns for their investors.

While they're in excellent positions to continue growing rapidly in the future, they're not without risk. Investors must understand the risks before loading their portfolios with these seven stocks.

FAQ

Magnificent Seven FAQ

What are the Magnificent Seven stocks?

Magnificent Seven stocks are seven mega-cap, tech-focused companies: Apple, Amazon, Alphabet, Meta Platforms, Microsoft, Nvidia, and Tesla.

Is there an ETF for the Magnificent Seven?

There is an ETF for the Magnificent Seven stocks. The Roundhill Magnificent Seven ETF focuses solely on the Magnificent Seven stocks. It held all seven with a roughly equal weighting. The fund had an ETF expense ratio of 0.29%.