Small-cap tech stocks — usually defined as technology companies with market capitalizations of no more than $2 billion — can be risky investments. Many of these small companies are pioneering new technologies. But their share prices can be highly volatile, and they risk being outcompeted by larger businesses with stronger balance sheets.

Some of these emerging technology businesses may be future leaders in their industries and are worth adding to your portfolio today. Investing in a basket of small-cap stocks — say five to 10 — is less risky than concentrating your holdings in a single company or two.

4 small-cap tech stocks to watch

4 small-cap tech stocks to watch

New technologies are reshaping the global economy and creating profit opportunities for small businesses and their shareholders. These four small-cap tech companies are worth watching in 2024:

1. PubMatic

1. PubMatic

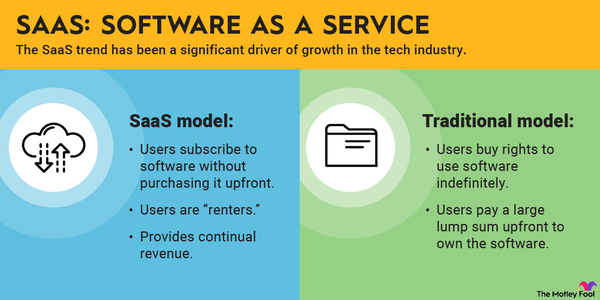

PubMatic (PUBM 0.0%) is a digital advertising technology firm. Its software provides internet publishers with a means to monetize their work by using artificial intelligence (AI) and automation to sell advertising.

PubMatic's publisher clients include a diverse group of businesses, including news organizations, e-commerce companies, video game makers, and streaming TV services. The company derives about half of its revenue from internet content formatted for mobile devices. Mobile represents a growing opportunity for PubMatic, especially outside the U.S., where PubMatic is just beginning to add customers. Digital marketing is another secular growth trend that benefits the company.

PubMatic completed its initial public offering (IPO) at the end of 2020. Although its stock experienced a sell-off in the second quarter of 2024, that may have been an overreaction; it's profitable, debt-free, and poised to take advantage of digital advertising and AI trends.

2. Harmonic

2. Harmonic

Harmonic (HLIT -0.37%) develops and sells video delivery software, products, system solutions, and services through its video and cable access segments. The video-streaming tech company is focused on improving livestreaming capabilities, especially for sports. Its boasts some big-name customers that include Comcast (CMCSA -0.48%) and Charter Communications (CHTR -2.46%).

Although revenues were down for the first quarter of 2024 and it posted a net loss, the company reported a record backlog. Revenues were down again for the second quarter, but they didn't fall as sharply as Wall Street had expected.

Company officials believe that Harmonic's backlog and a restructuring will restore it to profitability. It's certainly on the right side of two major secular trends: The continuing rollout of 5G networks and increasing popularity of video streaming are likely to benefit companies that specialize in video delivery.

3. ACM Research

3. ACM Research

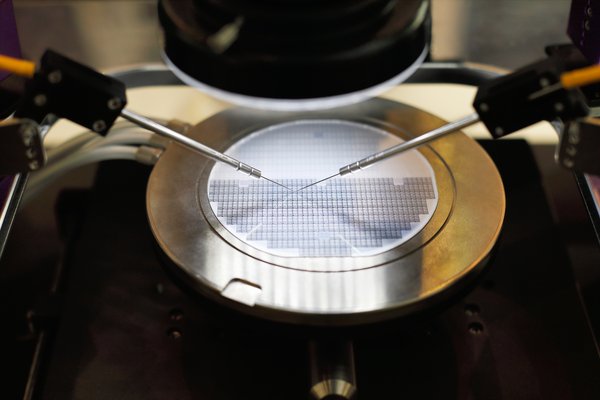

It's not just giant tech companies like Nvidia, Apple, and Microsoft that are looking at major profits from the AI boom. A number of smaller, more-focused companies could ride the wave to big profits, as well. ACM Research (ACMR 2.39%), a manufacturer of semiconductor cleaning equipment, may be a good small-cap bet for investors seeking opportunities from growth stocks.

Although much of the company's demand comes from Chinese chip foundries — a lucrative but potentially unstable market given current trade tensions between the U.S. and China — its equipment generally isn't used for advanced chips that are subject to sanctions.

ACM Research reported a 40% jump in revenue $202.5 million in the second quarter of 2024, beating the consensus estimates of $163.1 million. Despite record revenue, strong profitability, and positive cash flow from operations, it still trades at an attractive forward price-to-earnings (P/E) ratio of 12.25.

The company's reliance on the Chinese market may worry some investors, but it also stands to benefit from the CHIPS Act of 2022, which provides $52 billion in manufacturing grants and research investments to boost the domestic semiconductor market.

4. Inseego

4. Inseego

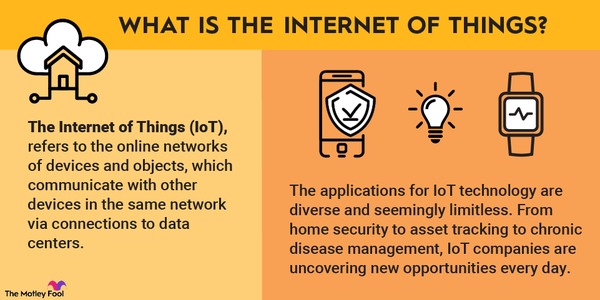

Inseego (INSG 8.04%) designs and sells wireless network hardware, and it also provides software for companies to deploy and remotely manage devices connected to their networks. As next-gen 5G technology networks are being built, demand for Inseego antennae and other infrastructure gear is accelerating.

Since remote work became normalized during the COVID-19 pandemic, more households are relying on mobile providers for high-speed internet, which is increasing the demand for Inseego's 5G mobile hotspot devices. These 5G devices are proving popular with schools, employers, and consumers alike.

T-Mobile (TMUS -3.07%), which is emerging as a market leader in this new era of digital mobility, offers Inseego's Wi-Fi routers to its customers. The telecommunications giant has the most 5G coverage among mobile service providers in the U.S. With 5G adoption still growing, Inseego could ride T-Mobile's coattails as the company continues to expand and improve its 5G network.

Inseego is also helping international mobile carriers to construct 5G infrastructure and increase consumer access to the internet, enabling the new age of mobility to continue to unfold.

Related investing topics

Why invest in small-cap tech stocks?

Why invest in small-cap tech stocks?

Investing small sums of cash in emerging tech businesses could produce substantial portfolio gains over time. But maintaining portfolio exposure to small-cap companies requires regularly finding new small companies in which to invest, since many successful small-cap companies eventually become mid-cap or even large-cap companies. Share prices of small-cap stocks can be highly volatile, but small-cap tech stocks can also yield significant returns for patient shareholders.