Although it's not a household name, Peercoin (CRYPTO:PPC) is a pioneer in cryptocurrency. Launched in 2012, it was the first coin to use a proof-of-stake system for processing transactions. This method of achieving network consensus requires relatively little energy consumption, making Peercoin the first green cryptocurrency.

In its early years, Peercoin was one of the top crypto coins. Although it has become less popular, a passionate development team is still working on it. Whether you're interested in Peercoin as an investment or as part of crypto's history, keep reading to learn more about this crypto and how it works.

Why it's unique

What makes Peercoin unique?

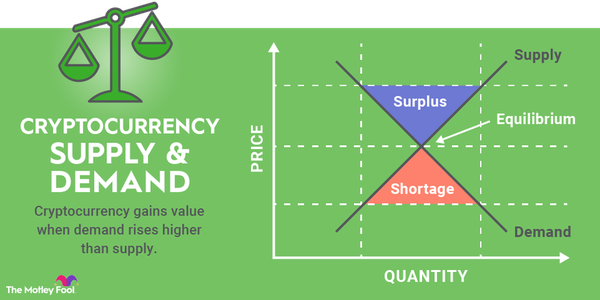

The most unique aspect of Peercoin is that it combines the proof-of-stake and proof-of-work systems to distribute new coins and process transactions. This hybrid system is much more energy efficient than a proof-of-work system alone.

Peercoin also rewards its holders who participate in staking (i.e., lending their crypto) and verifying transactions. These holders earn Peercoin equivalent to 1% per year of the value staked or owned.

This reward system means Peercoin has built-in inflation, and there is no maximum supply of Peercoins. Peercoin's inflation rate isn't exactly 1%, though, because those who don't participate in staking or minting transactions receive nothing.

How it works

How Peercoin works

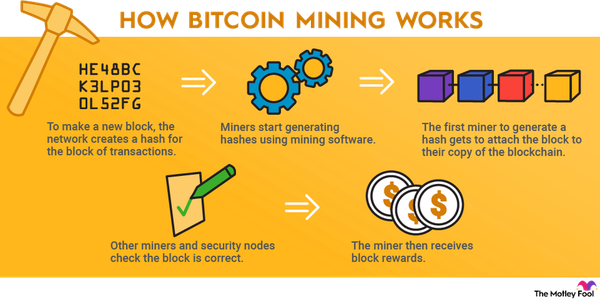

Peercoin is a cryptocurrency that can be bought, sold, and used for money transfers. It uses blockchain technology for transaction records. The blockchain is a public ledger that anyone can view. Each block contains transactions, and when a block of transactions is verified, it's added to the blockchain.

Peercoin uses a proof-of-work system for coin distribution. Miners receive Peercoin for solving mathematical problems using mining devices. Essentially, it's a race to solve complex mathematical problems using specialized mining devices, so the entire process uses a significant amount of energy.

A proof-of-stake system is used for verifying transactions. Anyone who has Peercoin can stake their coins to participate in this process. When you stake Peercoin, you're pledging your coins to the network to be used for transaction verification. There's no risk to your coins; you can unstake them later if you want.

The Peercoin protocol selects the next person to verify a block of transactions based on the number of coins held and how long they've held them. There's also randomization involved.

Peercoin technically calls this process minting instead of staking. The terms mean the same thing, but in the time since Peercoin launched, staking has become the more widely used term for cryptos that use proof-of-stake systems.

Peercoin used proof of work more in its early days to better distribute coins and decentralize the network. Over time, it has transitioned to using proof of stake more. It will always use a hybrid system, but it mostly relies on proof of stake.

How to buy

How to buy Peercoin

It's difficult to get Peercoin because major cryptocurrency exchanges don't list it. Uniswap (UNI -2.18%), a decentralized crypto exchange, is one of the larger platforms that offers it. Uniswap doesn't let you buy or sell Peercoin with fiat money, though. You have to connect a crypto wallet and swap another crypto token for it.

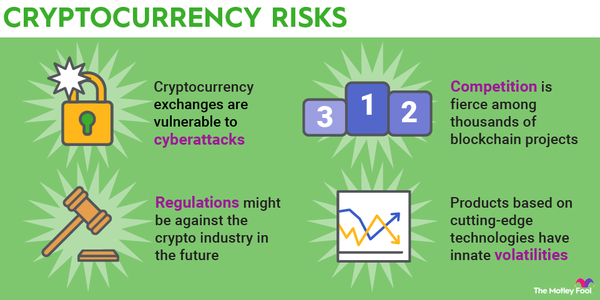

Risks

What are the risks of investing in Peercoin?

The main risks of investing in Peercoin are the lack of liquidity and popularity. It's difficult to buy and sell, and there's little trading volume, even on exchanges that offer it. Peercoin also faces greater competition from eco-friendly cryptocurrencies.

Peercoin was the first cryptocurrency to prioritize sustainability, but it's no longer the only one. There are now many coins with smaller carbon footprints that are far more well-known than Peercoin. One example is Cardano (CRYPTO:ADA), which uses proof of stake, and Ethereum (ETH 0.44%) is transitioning to a proof-of-stake system. Both those coins are much larger than Peercoin.

While other coins have been thriving, Peercoin hasn't done nearly as well. In 2013, it was in the top three largest cryptocurrencies. By 2024, it had fallen out of the top 1,000. Crypto enthusiasts rarely talk about Peercoin since its small online community isn't very active.

To be fair, Peercoin has been around for a long time and still has a dedicated team working on it. This isn't a dead project. But it's unlikely Peercoin has much growth potential at this stage of the game.

Versus Bitcoin

Peercoin versus Bitcoin

Here are the differences between Peercoin and Bitcoin (CRYPTO:BTC):

| Metric | Peercoin | Bitcoin |

|---|---|---|

| Release date | Aug. 12, 2012 | Jan. 9, 2009 |

| Maximum coin supply | No maximum | 21 million |

| Consensus protocol type | Proof of stake and proof of work | Proof of work |

| Mining algorithm | SHA-256 | SHA-256 |

| Average transaction time | 8.5 minutes | 10 minutes |

The most notable differences between Peercoin and Bitcoin are their maximum supplies and consensus protocols. Bitcoin is deflationary because it has a maximum supply of 21 million. The creators of Peercoin, on the other hand, didn't put a hard limit on the number of coins. And because of Peercoin's consensus protocol, it uses only a fraction of the energy Bitcoin uses.

Related investing topics

Should I buy

Should you buy Peercoin?

In some respects, Peercoin was ahead of its time. It focused on sustainability and environmentally responsible investing years before Bitcoin's rampant energy usage would get media attention. Even if it hasn't paid off as much as other coins, it's notable for introducing proof of stake in cryptocurrency.

Lyle Daly has positions in Bitcoin, Cardano, and Ethereum. The Motley Fool has positions in and recommends Bitcoin, Cardano, and Ethereum. The Motley Fool has a disclosure policy.