What it means to live a rich life is different for everyone. But one goal most of us share is building financial wealth over time.

Fortunately, the wealth-building process can be formulaic. The basic steps include establishing active and passive sources of income, living within a budget, and investing consistently over time.

Step 1: Making money

Step 1: Making money

You can make money actively through your job or passively, by way of hands-off investments. Those who are serious about building wealth generally seek both types of income.

Active income

Active income, also called earned income, is the money you earn from working a job, freelancing, side hustles, or any other activity that requires your ongoing participation.

Because you must work to earn active income, it's smart to pursue a paid activity that's sustainable in the long term. Ideally, you would target a line of work that is enjoyable, achievable, and profitable enough to fund your lifestyle.

Landing that ideal role can be a long process since most jobs don't offer all these attributes at once. You might have to begin your career with low-level responsibilities and work your way up to a more fulfilling job description. You may need to secure a degree or further training before you apply for a big promotion.

If you don't have that sustainable career today, identify the obstacles and strive to eliminate them over time. Earning a good income from a career you enjoy will make it easier and mathematically simpler to build wealth over time.

Passive income

Passive income is generated with little or no active work on your part. Ideally, the income stream can continue indefinitely with minimal oversight.

Examples of passive income include rents from investment real estate, book royalties, or passively held stock investments. Passive income sources typically require a sizable upfront investment in time or money.

Step 2: Living within a budget

Step 2: Living within a budget

Budgeting is an essential personal finance skill. When you can create a budget and stick to it, you can accomplish any financial goal you set -- from paying down debt to saving for retirement.

Expense tracking

Expense tracking is the first step of budgeting. You must know what you are spending today before you can define what you should be spending, given your income and wealth goals.

You can track expenses on paper, in a spreadsheet, or with an app. As you document your expenses, you'll want to categorize them as discretionary and non-discretionary.

- Discretionary expenses are not essential. You have more control over these items because you don't need them to survive. The money you spend on dining out, entertainment, and vacations is discretionary. If your budget doesn't balance, you can look to cut back in these areas first.

- Non-discretionary expenses are unavoidable. Rent, utilities, groceries, and car insurance are usually non-discretionary expenses. You can also reduce your discretionary expenses, but this may require lifestyle changes. To lower your rent, for example, you might have to move or find a roommate.

Setting spending limits

Setting spending limits is the second step of budgeting. Those limits should be dictated by your financial goals and your income.

- Financial goals. Common financial goals are to save more, invest more, and pay down debt. Start by identifying how much you want to dedicate monthly to each of these. These values should be non-negotiable line items within your budget.

- Income. Next, total your expenses, including the budgeted amounts for your financial goals. Compare that total to your income, both active and passive, before 401(k) contributions. If the expense total is higher, you must trim your spending or increase your income. If the income total is higher, raise your allocations for debt payments, emergency fund deposits, and investing contributions.

A careful review of your spending habits should reveal the most obvious savings opportunities in the short term. You can also set medium-term goals for larger spending reductions. Some examples of quick and not-so-quick ways to spend less include:

- Trim your grocery bill by using coupons, sale flyers, and generic products.

- Gather new quotes for car insurance to see if lower premiums are available.

- Set a weekly or monthly limit on how many times you'll dine out.

- Cancel streaming subscriptions.

- Explore whether you can give up your car for public transportation or a bicycle.

- Pay off debt to spare yourself recurring interest charges.

If your expenses are already as lean as they can be, look to add another income source. Freelance work and side hustles are options. Use any leftover income to invest in passive income so you won't be working two jobs forever.

After you define a budget that balances and supports your financial goals, lean into it. Automate your 401(k) contributions so your retirement balance grows without any action from you. Even better, make full use of your employer's 401(k) matching contributions. Matching contributions are free, and they expedite the growth of your net worth in a meaningful way.

Plan to deploy other amounts related to your goals immediately after you get paid, so there's no chance you'll spend this money on something else.

Finally, avoid using credit cards, which can mask overspending. If you do overspend in one category, cut back somewhere else to make up the difference.

The value of an emergency fund

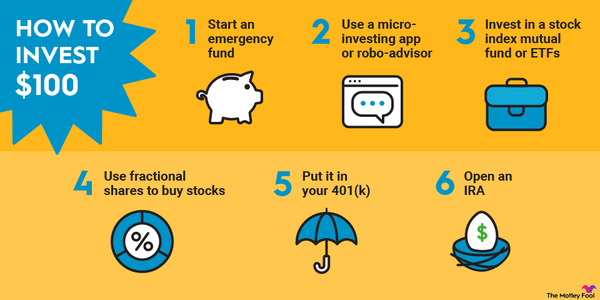

Soon after you create a budget, you may realize that life is tough to plan. Your pet might get sick, you might get hit by an uninsured driver, or you might lose your job. In those scenarios, having an emergency fund can spare you from high debt balances that are hard to repay.

The usual advice is to keep three to six months' worth of living expenses in a cash savings account for emergencies. When something unexpected happens, you can reach for the cash rather than a credit card. Rebuilding the cash savings balance will be far easier than repaying interest-bearing debt.

Step 3: Investing

Step 3: Investing

Investing in the stock market is the third step of the wealth-building process. This step is critical because the stock market's long-term, average returns are well more than average inflation rates. Investing in assets that outpace inflation is a necessity for wealth creation.

Note that disciplined stock market investing is what can make you a millionaire over time. Careless speculation and profit-chasing, on the other hand, can undermine your wealth efforts. To practice disciplined investing, define your risk tolerance, know your timeline, follow a suitable asset allocation, and stay patient through market turbulence.

Define your risk tolerance. Risk tolerance refers to your willingness to accept potential losses. You have a high risk tolerance if you can handle volatility in exchange for higher profit potential. If you don't want to see your portfolio value dip for any reason, you have a low risk tolerance.

Know your timeline. Your timeline depends on when you need to use the investment wealth you've created. If you are a young retirement investor, you have a long timeline. Your timeline is shorter if you're investing to fund a home down payment in 10 years.

Long investment timelines provide more reliable returns and allow for more aggressive investing.

Follow a suitable asset allocation. Asset allocation refers to the composition of your investment portfolio in terms of asset type. The relative amounts you invest in, say, stocks vs. bonds largely determine your portfolio's risk level. A 50-50 split between stocks and bonds is conservative, while a 90-10 split is aggressive.

Your asset allocation can be more granular, of course. For a globally diversified portfolio, for example, you might define exposures for international and domestic stocks and bonds, plus alternative assets like cryptocurrency, non-fungible tokens (NFTs), and commodities like gold and silver.

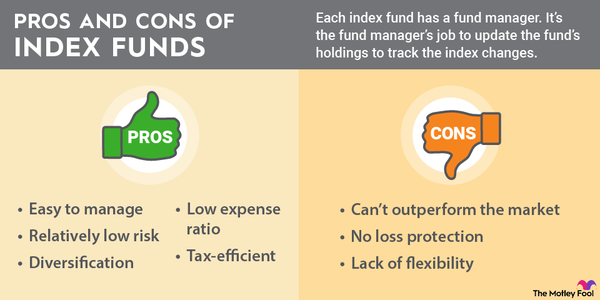

However you define your asset allocation, you can fulfill it with individual positions or diversified mutual funds and exchange-traded funds.

Stay patient through market turbulence. Normal volatility in the financial markets can be challenging for novice investors. The human instinct is to stem losses by selling. Unfortunately, that instinctual response is usually the worst thing you can do for your investment returns. Selling when the market is down locks in losses and takes you out of contention for recovery gains.

If you're invested in good companies, it's generally best to do nothing when the market takes a dip. Wait long enough and your portfolio should recover and return to growth.

Two facts can inspire patience and longevity in your investing practice. One, the stock market has always returned to growth after a downturn. And two, the stock market has never lost value over periods of 20 years or more.

Buy-and-Hold Strategy

Related investing topics

Your wealth-building manifesto

You can build wealth over time by establishing sustainable income sources, controlling your spending, and investing in the financial markets over time. Even if you've never invested before, investment success is achievable when you have a solid strategy involving good companies, a long timeline, appropriate asset allocation, and the fortitude to weather the inevitable stock market storms.

Fortunately, you don't have to define your entire wealth plan today. You can start by taking small, basic steps in the right direction. You might start recording your spending or investing $20 monthly. Stay with it, and you will see progress. As your small steps compound, your path to wealth will take shape.