There are so many different metrics that you can use to evaluate a potential stock investment, including price to free cash flow (sometimes abbreviated as P/FCF). Price to free cash flow tells a particular story about how the market values a company vs. how much money it earns.

Overview

What is price to free cash flow?

Price to free cash flow is a ratio that compares the market capitalization of a company to its free cash flow. It's considered a fairly good metric because it shows how well or poorly a company is priced on the market compared to its operating cash flow.

Since operating cash flow is where many businesses derive most of their day-to-day value, comparing the two figures makes sense. Basically, it answers the question, "What do shareholders think this company is worth compared to its cash production?"

How to calculate

How do you calculate price to free cash flow?

Price to free cash flow is very easy to calculate. Simply find the free cash flow on the cash flow statement and the current market capitalization after the closing bell from your favorite stock reporting resource. (Don't try to do this with numbers during an active trading day, or you'll drive yourself mad.)

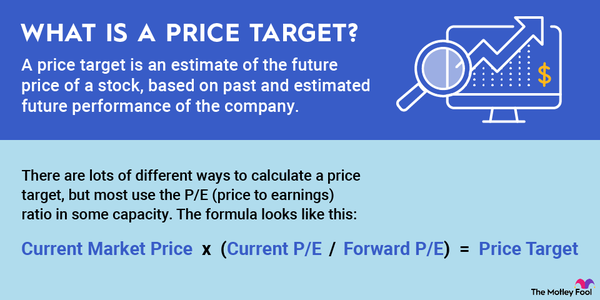

Now, divide market capitalization by free cash flow, and you'll get price to free cash flow. The equation looks like this:

Price to free cash flow = Market capitalization / Free cash flow

P/FCF vs. P/CF

Price to free cash flow vs. price to cash flow

There's another, similar metric that's easy to confuse with price to free cash flow, and that's price to cash flow (P/CF). They sound very similar, and they measure things that are somewhat similar, but they are definitely not the same.

Price to free cash flow compares the shareholder's equity against the actual cash flow of the company, free of capital expenditures, working capital, and dividends. Price to cash flow, on the other hand, looks at shareholder's equity compared to all cash on hand, even if it's cash that's going out, like those dividends. Many consider price to free cash flow to be the better metric.

Related investing topics

Why it matters

Why should price to free cash flow matter to investors?

Price to free cash flow can tell an investor how the stock they're considering is priced compared to the actual money the company is making. Of course, this isn't a metric that's useful by itself, but when you compare price to free cash flow of your target company against its competition, a picture can emerge.

Companies with low price to free cash flow compared to their nearest competitors are often undervalued and may even be in value stock territory. Companies with high price-to-free cash flow ratios compared to their competitors may be at or near their price peaks, which is not the right time to buy anything.

Of course, this is just one metric that you should be thinking about -- definitely not a metric that can tell you if you should buy or sell a stock on its own. Instead, do the calculation and consider why the price to free cash flow is what it is. A low number is generally pretty good, but not if there's a scandal brewing or a recent recall has cropped up that may cost the company a lot of money in the upcoming months and years.

Since free cash flow is a backward-looking metric, any significant changes in the business's operations will take time to be reflected in the price-to-free cash flow ratio, which can create a false sense of security.