The United States Natural Gas Fund (UNG 10.07%) allows investors to track the daily price movements of natural gas. The fund holds futures contracts and other derivatives to provide investors with a way to make a short-term directional bet on the price of natural gas.

The fund makes it easy to bet on the thesis that the price of natural gas in the U.S. will move meaningfully in the short term. Traders can make this gamble without needing to open a commodity futures account and learn how to trade futures. They also don't need to risk investing in a natural gas stock that might underperform the price of gas in the near term.

However, the United States Natural Gas Fund also has serious drawbacks. The costs of rolling natural gas futures contracts forward (and the fund's expense ratio) eat into its returns over the long term, so this fund is only suitable for a short-term trade.

Expense Ratio

This guide will show you everything you need to know about the United States Natural Gas Fund and teach you how to invest in ETFs for beginners.

What is it?

What is the United States Natural Gas Fund?

The United States Natural Gas Fund is an exchange-traded security similar to an exchange-traded fund (ETF). It primarily invests in natural gas futures contracts. The fund will also hold other natural gas-related futures contracts, forwards, and swap contracts. It collateralizes these contracts with cash, cash equivalents, and U.S. Treasury bonds with remaining maturities of less than two years.

The fund aims to track the daily price movements of natural gas. It benchmarks its returns against futures contracts traded on the New York Mercantile Exchange (NYMEX) that expire in the next month and have at least two weeks until expiration.

The fund has a couple of notable benefits. It provides investors exposure to natural gas without knowing how to invest in futures contracts. It also enables them to bet directly on natural gas instead of investing in a natural gas stock, which might not move in the same direction as gas prices.

However, it also has some major drawbacks. The fund needs to roll its futures contracts forward as they near expiration, which eats into returns (expiring contracts tend to have a lower price than those with more time until expiration). In addition, fees (from rolling contracts and fund management costs) eat into the fund's returns.

Because of these issues, this fund is unsuitable for long-term investment. It's best for making a short-term trade to potentially profit from an expected near-term rally in the price of natural gas.

How to buy

How to buy the United States Natural Gas Fund

One of the benefits of the United States Natural Gas Fund is that you don't need a futures trading account to make a trade on natural gas prices. This fund trades just like any stock, enabling anyone to buy shares in their regular brokerage account. Here's a four-step guide to help you add the energy ETF to your portfolio.

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any ETF. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time researching the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years. So, if you have $10,000 to invest, you'd want to invest about $400 across around 25 different holdings.

However, this fund is different from others. It's not an ideal long-term holding. Instead, it's best for a short-term bet on the direction of the price of natural gas, so it's a much riskier investment vehicle. As such, you'll likely want to allocate a much smaller percentage of your portfolio (money you can afford to lose) to this fund.

Step 3: Do your research

You need to thoroughly research any investment before committing your hard-earned money. When analyzing an ETF, you should review its strategy, holdings, expense ratio, and historical performance. You should also look at how it compares to the best ETFs to buy.

In the case of the United States Natural Gas Fund, you must thoroughly understand how this fund works and its associated risks. You also must have a clear thesis on why you believe the price of natural gas will make a meaningful short-term move.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the investment, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The ticker (UNG for United States Natural Gas Fund).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at market price.

Once you complete the order page, click to submit your trade and add the natural gas fund to your portfolio.

Holdings

Holdings of United States Natural Gas Fund

The United States Natural Gas Fund had five holdings as of mid-2024:

- Commodity Interests: Natural gas futures contracts expiring in August 2024 ($573.2 million)

- Swaps: TRS Soc Gen SGIXCNG1 ($104.2 million)

- Cash: Bank of New York Mellon (BK 1.29%) cash reserve ($485.9 million), U.S. dollars ($281.3 million), and Morgan Stanley's (MS 2.14%) treasury liquidity fund ($71 million)

The fund had about $668 million of natural gas futures and swaps contracts collateralized by $811 million in cash and equivalents.

Should I invest?

Should I invest in the United States Natural Gas Fund?

Investing is a very personal endeavor. You should invest in things that align with your risk tolerance and return objectives. With that in mind, here are some reasons you might want to invest in the United States Natural Gas Fund:

- You have a thorough understanding of how this fund works.

- You're very bullish about natural gas due to a pending near-term catalyst.

- You're comfortable with the risks of investing in this fund, including that it could lose significant value if natural gas doesn't deliver a meaningful rally in the short term.

- You're a very disciplined investor who will sell if your thesis doesn't play out as expected.

- You're seeking a sector ETF or mutual fund focused on the natural gas industry.

On the other hand, here are some reasons you might decide against investing in this fund:

- You don't understand how this fund works.

- You don't have a short-term bullish thesis on natural gas.

- You're seeking a lower-risk way to invest in natural gas.

- You want to make a longer-term investment in natural gas.

- You're seeking a lower-cost way to invest in natural gas.

- You want to invest in a dividend ETF to generate passive income.

Dividends

Does the United States Natural Gas Fund pay a dividend?

The United States Natural Gas Fund does not pay a dividend. The fund invests primarily in natural gas futures contracts expiring in a month, which don't generate any income. The fund's purpose is as a short-term investment vehicle to make a bet on the near-term price movement of natural gas.

Expense ratio

What is the United States Natural Gas Fund's expense ratio?

Fund managers charge fees, known as the expense ratio, to execute their investment strategy on behalf of investors. This fund has a management fee of 0.6% and a total expense ratio of 1.06%. That's a very high expense ratio due, in part, to the management oversight required to roll futures contracts forward each month.

To put the expense ratio into a different context, every $1,000 invested in the fund would cost $10.60 annually. The fee would really add up over the long term, which has contributed to its historical performance.

Historical record

Historical performance of the United States Natural Gas Fund

Futures trading is very challenging. That's evident in the performance of this fund over the years:

| Fund | 1-Year | 5-Year | 10-Year |

|---|---|---|---|

|

United States Natural Gas Fund |

(47.51%) | (31.10%) | (28.03%) |

|

Benchmark Futures Contract |

(49.34%) | (31.40%) | (27.97%) |

One factor driving those poor returns is the decline in the price of natural gas. The Henry Hub natural gas spot price has fallen 17% over the past year (it's also down over the last five- and 10-year periods at 14% and 52%, respectively). Given this underperformance, this fund is unsuitable as a long-term investment.

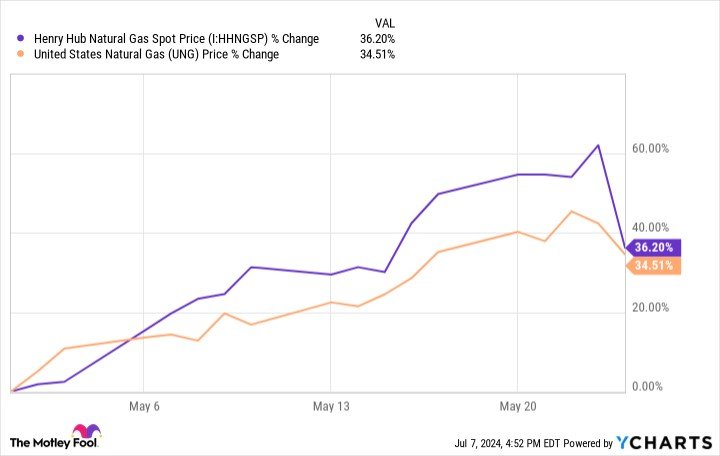

However, the fund does a much better job tracking the price of natural gas in the short term. For example, gas prices spiked in May 2024, which drove a similarly strong surge in the value of this fund:

Given this dynamic, investors should buy this fund only when they firmly believe the price of natural gas will spike over a short period (due to a winter storm or other catalyst).

Related investing topics

The bottom line on the United States Natural Gas Fund

The United States Natural Gas Fund is a specialized fund. It enables anyone to make a short-term bet on natural gas prices without opening a futures account. It's imperative that investors use this fund only as a short-term trading vehicle. The fund's costs eat into its returns over the long term, which has contributed to its poor historical performance.

FAQ

Investing in United States Natural Gas Fund: FAQ

Is UNG ETF a good investment?

The United States Natural Gas Fund (UNG) can be a good investment in specific situations. It aims to track the daily price movements of natural gas via futures contracts. It does a good job of that in the short term, making it an ideal trading vehicle for those who believe a pending catalyst will cause the price of natural gas to spike within a short period.

However, the fund isn't an ideal long-term investment. Its expense ratio and the cost of rolling futures contracts eat into its returns, so investors shouldn't hold the fund for very long.

How to invest in US natural gas?

There are a few ways to invest in U.S. natural gas. You could open a futures account and invest in futures contracts to profit from a potential rise in gas prices. Another option is to invest in a fund that buys futures contracts, like the United States Natural Gas Fund. Alternatively, you could invest in a natural gas producer since its stock should rise in value along with the price of natural gas.

What is the symbol for the natural gas ETF?

The symbol for the United States Natural Gas Fund is UNG.

What kind of ETF is UNG?

The United States Natural Gas Fund (UNG) isn't an ETF. It's an exchange-traded security designed to track the daily price movements of natural gas.