The SPDR Bloomberg 1-3 Month T-Bill ETF (BIL 0.01%) enables anyone to easily invest in short-term U.S. Treasury bills (T-bills). These government obligations help the U.S. Treasury fund its short-term cash requirements. Investors use T-bills to park their short-term cash in a low-risk, interest-bearing investment.

This exchange-traded fund (ETF) provides exposure to T-bills with remaining maturities of between one and three months. It's an ideal cash management tool for investors since the fund lets them earn some interest income on their idle cash.

Exchange-Traded Fund (ETF)

This guide will teach you everything you need to know about the SPDR Bloomberg 1-3 Month T-Bill ETF and how to invest in ETFs for beginners.

What is it?

What is the SPDR Bloomberg 1-3 Month T-Bill ETF?

The SPDR Bloomberg 1-3 Month T-Bill ETF provides investors with access to short-term U.S. Treasury bills. The passively managed fund aims to track the results of the Bloomberg 1-3 Month U.S. Treasury Bill Index.

Focusing on short-duration T-bills reduces an investor's exposure to fluctuations in interest rates compared to an ETF focused on longer-duration securities, such as the iShares 20+ Year Treasury Bond ETF (NYSEMKT:TLT). The short-duration focus also makes it an ideal cash management tool.

The State Street (STT 0.78%)-managed ETF enables investors to target a specific segment of the Treasury market through a single fund -- in this case, T-bills that mature over the next one to three months. The fund allows investors to invest in T-bills through their brokerage account instead of having to create a separate account with the U.S. government (TreasuryDirect.gov).

How to buy

How to buy SPDR Bloomberg 1-3 Month T-Bill ETF

Anyone can buy shares of the SPDR Bloomberg 1-3 Month T-Bill ETF. It trades on major stock exchanges, allowing you to purchase shares in your brokerage account. Here's a four-step guide to help you add the bond ETF to your portfolio.

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any ETF. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time researching the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years. So, if you have $10,000, you'd want to invest about $400 across 25 different holdings.

However, owning ETFs like the SPDR Bloomberg 1-3 Month T-Bill ETF isn't the same as owning shares of a publicly traded company. It holds short-duration T-bills backed by the U.S. government. Because of its focus on lower-risk T-bills, investors could allocate a larger portion of their portfolio to this ETF. It's an ideal holding for idle cash because it will generate some interest income.

Step 3: Do your research

You need to thoroughly research any potential investment before committing your money. When analyzing an ETF, you should review its strategy, holdings, expense ratio, and historical performance and compare it to the best ETFs to buy.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the investment, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The ticker (BIL for SPDR Bloomberg 1-3 Month T-Bill ETF).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order because it guarantees you buy shares immediately at market price.

Once you complete the order page, click to submit your trade and add the bond ETF to your portfolio.

Holdings

Holdings of the SPDR Bloomberg 1-3 Month T-Bill ETF

The SPDR Bloomberg 1-3 Month T-Bill ETF focuses on holding short-duration T-bills. As of mid-2024, the ETF had 24 holdings. The T-bills all matured within three months, with an average remaining term of one and a half months. The ETF rebalances its holdings at the end of each month, replacing maturing T-bills with new ones with remaining maturities of one to three months.

Should I invest?

Should I invest in SPDR Bloomberg 1-3 Month T-Bill ETF?

Investing can be very personal. You should invest in things that align with your risk tolerance and return objectives. With that in mind, here are some reasons you might consider investing in the SPDR Bloomberg 1-3 Month T-Bill ETF:

- You're seeking a low-risk, fixed-income investment.

- You want to invest in a sector ETF focused specifically on short-duration T-bills.

- You're looking for a cash management tool to hold idle cash and generate some interest income.

- You want a very liquid investment.

- You're seeking to generate income on a monthly basis.

Conversely, here are some reasons you might not want to invest in this particular bond ETF:

- You'd prefer to buy T-bills directly from the U.S. government.

- You're seeking a bond ETF or mutual fund with a broader focus on the U.S. Treasury market or global bond market.

- You're seeking a dividend ETF with a higher total return potential than this fund can deliver.

- You think the federal funds rate will fall in the coming months and want to invest in an ETF focused on longer-duration T-bills.

Dividends

Does SPDR Bloomberg 1-3 Month T-Bill ETF pay a dividend?

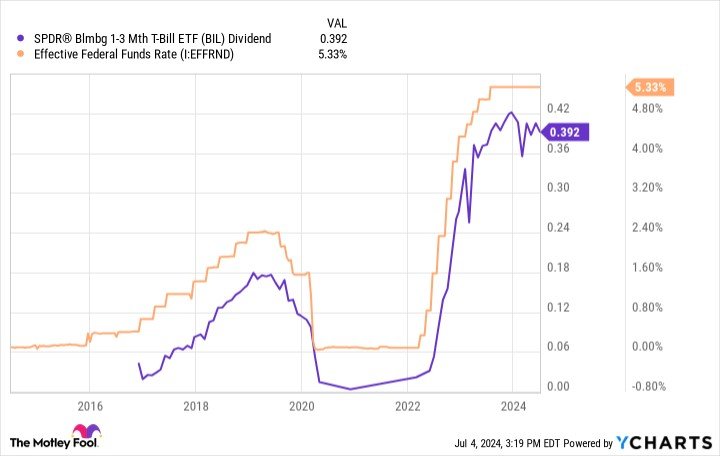

The SPDR Bloomberg 1-3 Month T-Bill ETF pays a dividend. It distributes income to investors monthly. In mid-2024, the fund had a distribution yield of about 5.2%.

T-bills are non-interest-bearing debt instruments. The Treasury sells them at a discount. At maturity, the government redeems the T-bill at its face value. The difference between the discount and the bill's face value is the interest income the holder earns at maturity.

Monthly interest payments from the SPDR Bloomberg 1-3 Month T-Bill ETF rise and fall based on the federal funds rate. When that rate is higher, the ETF pays a higher monthly dividend:

Expense ratio

What is the SPDR Bloomberg 1-3 Month T-Bill ETF's expense ratio?

ETF sponsors like State Street charge a fee, known as the expense ratio, to manage the fund's assets on behalf of investors. The SPDR Bloomberg 1-3 Month T-Bill ETF's expense ratio is 0.1356%, higher than other ETFs focused on short-duration T-bills. For example, the iShares 0-3 Month Treasury Bond ETF (SGOV 0.0%) has an expense ratio of 0.09%.

ETF Expense Ratio

At that rate, every $10,000 invested in the SPDR Bloomberg 1-3 Month T-Bill ETF would cost about $13.56 in management fees each year. That compares to $9 annually for a similar investment in a rival short-duration T-bill ETF like the iShares 0-3 Month Treasury Bond ETF. Given its higher expense ratio, investors would cede more of their income to the fund's manager.

Historical record

Historical performance of the SPDR Bloomberg 1-3 Month T-Bill ETF

T-bills are highly susceptible to changes in the federal funds rate. When the rate is low (like it has been for most of the past decade), the income generated by T-bills is low. Conversely, a higher federal funds rate (which we've experienced in more recent years) increases the income generated by short-duration T-bills:

| Fund | 1-Year | 3-Year | 5-Year | 10-Year |

|---|---|---|---|---|

|

SPDR Bloomberg 1-3 Month T-Bill ETF |

5.38% | 2.81% | 1.97% | 1.31% |

|

Benchmark (Bloomberg 1-3 Month U.S. Treasury Bill Index) |

5.51% | 2.97% | 2.13% | 1.45% |

As that table shows, the SPDR Bloomberg 1-3 Month T-Bill ETF does a solid job tracking its benchmark.

Related investing topics

The bottom line on the SPDR Bloomberg 1-3 Month T-Bill ETF

The SPDR Bloomberg 1-3 Month T-Bill ETF allows anyone to easily invest in T-bills through their brokerage account, making it a great cash management tool. It allows investors to generate some additional interest income on idle cash.

FAQ

Investing in the SPDR Bloomberg 1-3 Month T-Bill ETF FAQ

How do you buy a three-month Treasury bill?

Investors have several ways to buy a 3-month Treasury bill. They can:

- Open an account with the U.S. government (TreasuryDirect.gov) and buy them directly.

- Buy T-bills with a remaining maturity of three months through their brokerage account (if it allows trading bonds).

- Purchase an ETF focused on short-duration T-bills, like the SPDR Bloomberg 1-3 Month T-Bill ETF or the iShares 0-3 Month Treasury Bond ETF.

How does SPDR Bloomberg 1-3 Month T-Bill ETF work?

The SPDR Bloomberg 1-3 Month T-Bill ETF is an ETF focused on short-duration T-bills. The fund holds T-bills with remaining maturities of one to three months. It rebalances at the end of each month, replacing maturing T-bills with those that mature in one to three months.

What is the Bloomberg 1-3 Month T-bill ETF?

The SPDR Bloomberg 1-3 Month T-Bill ETF is a passively managed fund that tracks the Bloomberg 1-3 Month Treasury Bill Index. It provides investors with exposure to short-duration T-bills, which they typically hold to generate interest income on idle cash.

How do investors buy the BIL ETF?

Buying the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) is easy. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares

- The ticker (BIL for SPDR Bloomberg 1-3 Month T-Bill ETF)

- The order type (limit order or a market order)

Once you complete the order page, click to submit your trade and add the bond ETF to your portfolio.