Schwab U.S. Dividend Equity ETF (SCHD -0.62%) empowers anyone to invest in the wealth-creating capabilities of dividend stocks. Over the last 50 years, dividend payers have delivered a higher average annualized total return than the equal-weighted S&P 500 index (9.2% versus 7.7%), with less volatility than the broader market. Companies with a history of increasing their dividends have delivered even higher total returns (10.2% annualized).

This exchange-traded fund (ETF) focuses on companies with solid track records of consistently paying dividends, most of which routinely increase their payouts. The fund is an excellent option for investors seeking to generate passive income while also realizing some stock price appreciation as the underlying companies grow in value.

Exchange-Traded Fund (ETF)

Here's everything you need to know about investing in the Schwab U.S. Dividend Equity ETF.

What is it?

What is the Schwab U.S. Dividend Equity ETF?

The Schwab U.S. Dividend Equity ETF enables you to invest in 100 of the best dividend-paying stocks through a single fund. The ETF aims to closely track the Dow Jones U.S. Dividend 100 Index. The index measures the performance of high-dividend-yielding stocks that trade in the U.S. These companies consistently pay dividends and have fundamentally stronger financial metrics than their peers.

How to buy

How to buy the Schwab U.S. Dividend Equity ETF

Anyone with a brokerage account can buy the Schwab U.S. Dividend Equity ETF. The dividend-focused fund trades on a major stock exchange, allowing you to purchase shares even if you don't have an account with Charles Schwab (SCHW 0.04%). Here's a four-step guide to show you how to invest in ETFs.

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any ETF. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time researching the brokers to find the best one for you.

Since this is a Schwab-sponsored ETF, include Charles Schwab in your research to see whether it might be a good broker for your situation. You'll also want to select a broker that allows you to buy and sell ETFs sponsored by Schwab.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

So, if you have $10,000, you'd want to invest about $400 across 25 different holdings. However, ETFs like the Schwab U.S. Dividend Equity ETF offer instant diversification (it holds 100 companies across nearly all stock market sectors). Given that built-in diversification, you could allocate much more of your portfolio to this ETF.

Step 3: Do your research

You need to thoroughly research any potential investment before committing your money. When analyzing an ETF, you should review its strategy, holdings, expense ratio, and historical performance and compare it to the best ETFs to buy.

Expense Ratio

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the investment, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (SCHD for Schwab U.S. Dividend Equity ETF).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order because it guarantees you buy shares immediately at market price.

Once you complete the order page, click to submit your trade and add the high-quality dividend ETF to your portfolio.

Holdings

Holdings of the Schwab U.S. Dividend Equity ETF

The Schwab U.S. Dividend Equity ETF is a passively managed fund that mirrors the holdings of the Dow Jones U.S. Dividend 100 Index. The index tracks roughly 100 dividend stocks known for consistently paying dividends backed by high-quality financial profiles. The Schwab U.S. Dividend Equity ETF had 103 holdings in mid-2024, led by:

- Cisco Systems (CSCO -0.15%): 4.1% of the fund's holdings.

- Home Depot (HD 0.05%): 4.1%.

- Texas Instruments (TXN 0.88%): 4%

- Chevron (CVX -0.4%): 4%.

- Amgen (AMGN -1.01%): 4%.

The fund's top 10 holdings account for about 40% of its net assets. The ETF offers fairly broad diversification across stock market sectors:

- Financials: 17.4% of the portfolio's value

- Health Care: 15.7%

- Consumer Staples: 13.9%

- Industrials: 13.5%

- Energy: 12.8%

- Consumer Discretionary: 10.1%

- Information Technology: 8.7%

- Communication Services: 4.7%

- Materials: 3.1%

- Utilities: 0.03%

Should I invest?

Should I invest in the Schwab U.S. Dividend Equity ETF?

Investing is a very personal venture. Not every stock or fund will be right for your situation. With that in mind, here are some reasons you might want to invest in the Schwab U.S. Dividend Equity ETF:

- You want to collect passive income.

- You'd like to earn a higher income yield than you can get from an S&P 500 index fund.

- You want to invest in a diversified portfolio of high-quality, higher-yielding dividend stocks.

- You don't want to be an active stock picker and manage a portfolio of dividend stocks.

- You're willing to exchange the potential for lower total returns for higher income and less volatility.

On the other hand, here are some reasons the Schwab U.S. Dividend Equity ETF might not be the best ETF to buy for you:

- You're seeking a more growth-focused investment.

- You want a fixed income stream.

- You want an even higher income yield.

- You'd prefer to invest directly in dividend stocks.

- You already own a lot of dividend stocks.

Dividends

Does the Schwab U.S. Dividend Equity ETF pay a dividend?

Yes, the Schwab U.S. Dividend Equity ETF pays a dividend. In mid-2024, the fund had a trailing-12-month dividend yield of 3.4%, more than double the S&P 500's dividend yield (around 1.3%). The higher dividend yield enables investors to collect more dividend income each year, providing them with a higher base return.

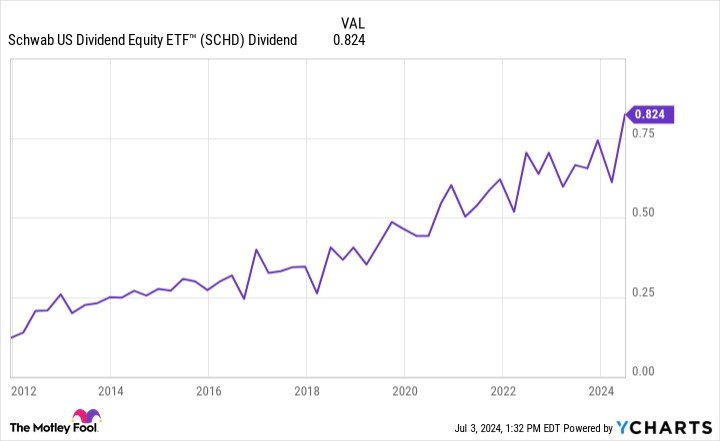

The fund distributes dividend income to investors each quarter. The payments rise and fall based on the dividend income generated by the fund's portfolio, less its expense ratio. While the payments tend to fluctuate from quarter to quarter, they have steadily risen over the years as the companies in the fund have increased their dividends:

Expense ratio

What is the Schwab U.S. Dividend Equity ETF's expense ratio?

ETF sponsors like Schwab charge fees known as expense ratios to manage funds on behalf of their investors. The Schwab U.S. Dividend Equity ETF has a 0.06% ETF expense ratio. That's a very low expense ratio for a passively managed ETF; the industry average is about 0.16%.

ETF Expense Ratio

For example, a $10,000 investment in the Schwab U.S. Dividend Equity ETF would incur $6 in management fees each year, about $10 less than other passively managed funds. The fund's lower expense ratio enables investors to keep more of the dividend income generated by the ETF's holdings. Although it might not seem like much at first, it adds up over time.

Historical record

Historical performance of the Schwab U.S. Dividend Equity ETF

Dividend stocks tend to deliver solid returns over the long term. That has certainly been the case for the Schwab U.S. Dividend Equity ETF over the years:

| Fund | 1-Year | 3-Year | 5-Year | 10-Year |

|---|---|---|---|---|

|

Schwab U.S. Dividend Equity ETF |

17.06% | 4.20% | 13.37% | 10.99% |

|

Benchmark (Large-Cap Value) |

22.47% | 6.25% | 11.40% | 8.72% |

As that table shows, the fund has outperformed its benchmark over the past five- and 10-year periods. However, while it has outperformed its benchmark, the fund has underperformed compared to the S&P 500 (15% annualized total return over the last five years and 12.9% during the past decade).

Even though the fund has lagged behind the broader market, it provides investors with more income and lower-volatility returns. Those features can make it a solid option for investors seeking an income-focused fund that can still put up solid total returns.

Related investing topics

The bottom line on Schwab U.S. Dividend Equity ETF

Schwab U.S. Dividend Equity ETF makes investing in high-quality dividend stocks easy. The fund owns shares of 100 companies known for their ability to pay consistent and steadily rising dividends. It can provide an instantly diversified portfolio of high-quality dividend stocks that can be a core holding of any investment portfolio.

FAQ

Investing in Schwab U.S. Dividend Equity ETF FAQ

How to invest in SCHD ETF

Anyone can invest in the Schwab U.S. Dividend Equity ETF (SCHD). The fund trades publicly on a major stock exchange, enabling anyone with a brokerage account to buy shares. To invest in the ETF, you would open the order page at your brokerage account and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares

- The stock ticker (SCHD for Schwab U.S. Dividend Equity ETF)

- Whether you want to place a limit order or a market order

Review your order and then click submit to add this dividend ETF to your portfolio.

Is Schwab U.S. Dividend Equity ETF a good investment?

The Schwab U.S. Dividend Equity ETF can be a good investment. Over the last decade, the fund has delivered an 11% annualized total return, roughly matching the returns of the Dow Jones U.S. Dividend 100 Index (11.1% average annual total return).

It has outperformed the returns of the average large-cap value stock (8.7% annualized total return). However, it has lagged the S&P 500 during that period (12.9% annualized total return).

This ETF can be a good investment for those seeking income and equity-like returns with less volatility than the broader market. Its features make it ideal for people at or nearing retirement or seeking a lower-volatility, income-focused investment to help diversify their portfolio and reduce risk.

How much does SCHD pay in dividends per month?

The Schwab U.S. Dividend Equity ETF (SCHD) pays quarterly dividends. As of mid-2024, the last four distributions were:

- July 1, 2024: $0.8241 per share

- March 25, 2024: $0.6110 per share

- Dec. 11, 2023: $0.7423 per share

- Sept. 25, 2023: $0.6545 per share

The payment fluctuates based on the dividends the fund receives from its holdings each quarter. Its payments over the last 12 months gave the fund a trailing dividend yield of 3.4%.

What companies are in the Schwab US Dividend Equity ETF?

In mid-2024, the Schwab U.S. Dividend Equity ETF held shares of more than 100 companies. The fund's holdings tended to pay higher-yielding dividends that steadily rose. The fund's five largest holdings were Cisco, Home Depot, Texas Instruments, Chevron, and Amgen.