Berkshire Hathaway (BRK.A -0.71%)(BRK.B -0.47%) is a holding company run by investing legend Warren Buffett. He took control of the former textile manufacturer in 1965 and transformed it into one of the largest companies in the world.

Berkshire serves as his investment arm. Buffett uses the cash flows generated by Berkshire's operating businesses and investments to acquire other companies and make new investments that grow shareholder value.

Berkshire Hathaway differs from other investment firms, like hedge funds. Anyone can invest in Berkshire Hathaway if they have enough money to buy at least one Class B share (more than $450 in late 2024).

For comparison, hedge funds are open only to accredited investors, meaning those with a high income or net worth and who can meet the fund's minimum investment, which can be $1 million or more. Berkshire Hathaway also doesn't charge exorbitant fees to its investors because it sees them as partners, not clients.

Accredited Investor

Buffett's company has a tremendous track record of growing value for shareholders. From 1965 through 2023, Berkshire's shares delivered a 19.8% compound annual return.

That has outperformed the S&P 500 by almost 2-to-1 (the S&P 500 has produced a 10.2% compound annual return during that period). Here's a step-by-step guide on buying Berkshire Hathaway shares and some factors to consider before investing in the company.

How to buy

How to buy Berkshire Hathaway stock

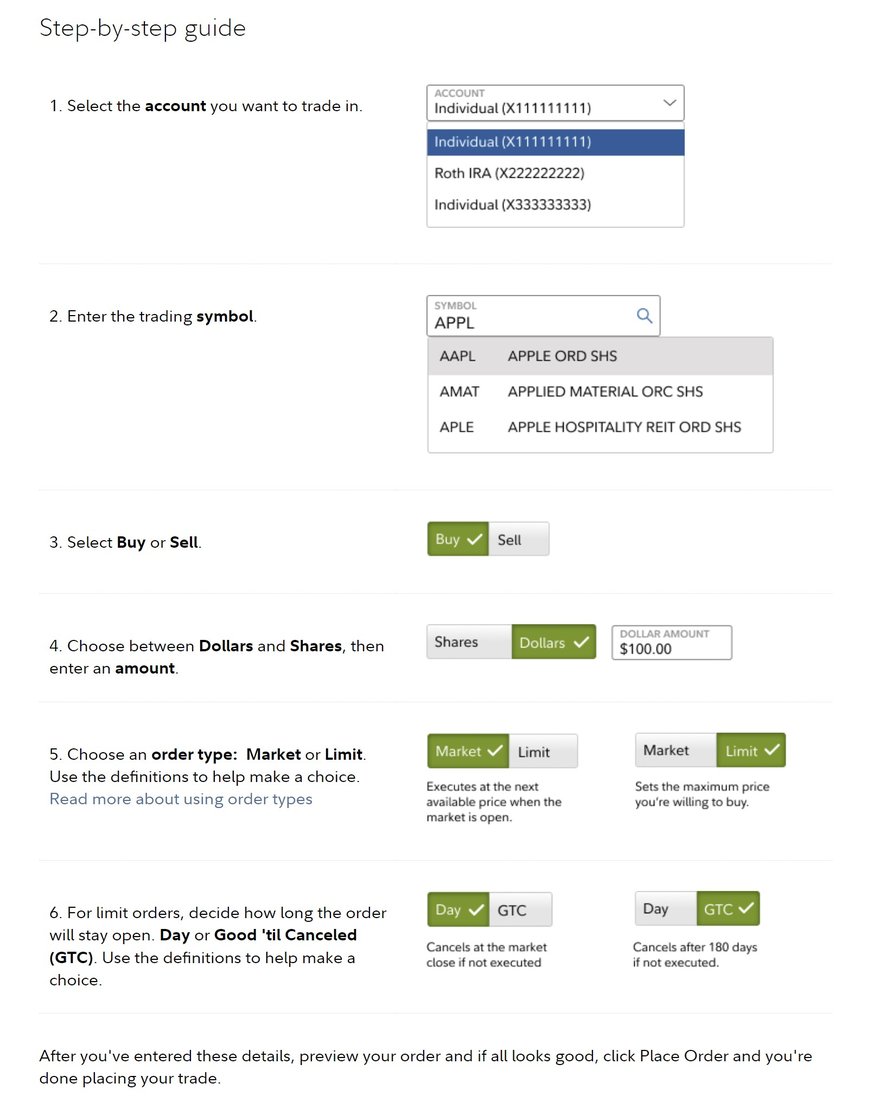

To buy shares of Berkshire Hathaway, you must have a brokerage account. If you still need to open one, here are some of the best-rated brokers and trading platforms and a step-by-step guide to buying Berkshire Hathaway stock using Fidelity's five-star-rated platform.

Fidelity makes it easy to buy stocks. Its website offers a video tutorial and a step-by-step guide. Here's a screenshot of how to place a stock trade with Fidelity.

On this page, fill in all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker symbol (BRK.B for Berkshire Hathaway).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price right at that moment.

Once you complete the order page, submit your order and become a Berkshire Hathaway shareholder.

Should I invest?

Should I invest in Berkshire Hathaway?

Before buying shares of Berkshire Hathaway, you must determine whether you want to invest directly in the company. First, let's review a summary of the company's business model.

Buffett and his investing partners use the money Berkshire's businesses earn for its shareholders and reinvest it in:

- Businesses they can control by acquiring 100% ownership: Berkshire Hathaway's operating businesses include insurance, railroad, utilities and energy, manufacturing, service, and retailing. Notable brands include GEICO, BNSF, Pampered Chef, Pilot Travel Centers, Fruit of the Loom, and See's Candies.

- Publicly traded stocks to passively own pieces of high-quality businesses: Some of the top stocks Warren Buffett's company owned as of late 2024 included Apple (AAPL 0.67%), Bank of America (BAC 1.32%), Coca-Cola (KO -1.52%), Chevron (CVX -0.4%), American Express (AXP -0.4%), and Kraft Heinz (KHC -1.83%).

Reasons to invest in Berkshire

Here are some reasons to consider purchasing the company's stock:

- You believe Berkshire Hathaway can deliver a higher return than an S&P 500 index fund.

- You like Warren Buffett's investment style and want to trust him and his team with your money.

- You don't need to earn dividend income.

- You believe Buffett and his team can put Berkshire's retained cash flows and cash balance to work in growing shareholder value over the long term.

- You understand how Berkshire Hathaway makes money and want to follow the company.

- You realize your investment in Berkshire Hathaway could lose money and might underperform the S&P 500.

Reasons not to invest in Berkshire

On the other hand, here are some factors to consider that might make you opt not to purchase shares of Berkshire Hathaway:

- You're worried about Warren Buffett's age and whether his eventual successors will follow his blueprint for growing shareholder value.

- You're concerned that the death of Buffett's long-time business partner, Charlie Munger, might affect the company's future performance.

- You're nearing or in retirement and need dividend income.

- You don't firmly believe Berkshire Hathaway can outperform the S&P 500 over the long term.

- You are a younger, more growth-oriented investor and don't like Buffett's value investing approach.

- You're too busy to follow Berkshire Hathaway and don't want to invest directly in individual stocks.

Profitability

Is Berkshire Hathaway profitable?

Profit growth helps power stock price appreciation over the longer term. That makes it a good area for beginning investors to focus on before buying shares.

Berkshire Hathaway is a consistently profitable company. Its operating profit rose 15% to $11.6 billion in the second quarter of 2024. The company benefited from higher insurance underwriting profits and increased interest income on its large cash balance.

The company retains all its earnings to allocate toward growing shareholder value. It also holds a lot of cash on its balance sheet -- a record $277 billion at the end of 2024's second quarter -- that it intends to deploy when it finds compelling investment opportunities. Berkshire's cash position ballooned after it cut its stake in Apple by almost 50% in the second quarter, raising a staggering $77 billion in cash.

Dividends

Does Berkshire Hathaway pay a dividend?

While Berkshire Hathaway is a very profitable company, it doesn't pay dividends to its shareholders. CEO Warren Buffett believes he and his team can create more value for shareholders by retaining that cash and allocating it toward initiatives that create shareholder value.

Dividend Payments

Those options include reinvesting it into existing businesses, making acquisitions, investing in publicly traded companies, or repurchasing shares when they trade at a discount to the company's estimated intrinsic value. The company bought back $345 million in stock during the second quarter of 2024, its lowest tally in years. It had repurchased $2.6 billion in the first quarter and $2.2 billion in the final period of 2023.

ETF options

ETFs with exposure to Berkshire Hathaway

Instead of actively buying shares directly, you can passively invest in Berkshire Hathaway stock by investing in a fund holding its shares. Berkshire Hathaway is among the larger publicly traded companies by market capitalization, making it a widely held stock.

Berkshire is in several stock market indexes, including the S&P 500 index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Berkshire Hathaway stock.

Exchange-Traded Fund (ETF)

According to ETF.com, 256 ETFs held a reported 140.3 million shares of Berkshire Hathaway in late 2024. The SPDR S&P 500 ETF Trust (SPY 0.58%) was the biggest holder, with more than 22 million shares.

However, the ETF with the largest allocation to Berkshire Hathaway was the iShares U.S. Financials ETF (IYF -0.13%), at more than 15% of the fund's total holdings. That compares to only about 1.7% from the SPDR S&P 500 ETF Trust, making the iShares U.S. Financials ETF a better option for investors seeking a more passive way to gain exposure to Berkshire Hathaway without directly buying shares.

Stock splits

Will Berkshire Hathaway stock split?

Berkshire Hathaway has never implemented a stock split for its Class A shares (BRK.A), which is one reason those shares traded at almost $700,000 apiece in late 2024. It will likely never split that class of its stock.

However, in response to unit investment trusts that were formed to allow small investors to invest in Berkshire stock (and to make its stock more accessible to more investors), Berkshire created Class B shares (BRK.B) in 1996 with a much lower price point. The company has only split that stock class once. It completed a 50-for-1 split in 2010. At the time of the split, shares were trading at around $3,500.

As of late 2024, Berkshire had not announced an upcoming stock split. With the Class B shares trading at more than $450 a share, it doesn't seem likely that Berkshire will split its stock anytime soon, given its historical trend.

Related investment topics

The bottom line on investing in Berkshire Hathaway stock

An investment in Berkshire Hathaway is one in Warren Buffett and his team. It's a wager that they can allocate the cash flows produced by Berkshire Hathaway's operating businesses and investments to create more value for shareholders.

They have done a phenomenal job growing value for investors over the years. While that past success is no guarantee of future returns, Berkshire Hathaway has the potential to be a solid long-term investment.

FAQ

FAQ on investing in Berkshire Hathaway stock

Can I buy Berkshire Hathaway stock?

Yes, you can buy shares of Berkshire Hathaway in a brokerage account. The company has two stock symbols: BRK.A and BRK.B. The Class B shares have a much lower share price (more than $450 per share in late 2024 compared to almost $700,000 for the Class A shares), making them a lot more accessible to most investors.

Is it worth investing in Berkshire Hathaway?

Buying shares of Berkshire Hathaway can be a very worthwhile investment. For example, as of late 2024, shares of Berkshire Hathaway had underperformed the S&P 500 over the last 10 years (12.7% versus 13.4%). However, it has been a stronger performer in other periods, including beating the S&P 500 over the last three years (18.6% versus 11.5%). While past performance is no guarantee of future success, the company is in an excellent position to continue growing shareholder value. Berkshire Hathaway's earnings are growing, and it has a strong cash position to deploy into value-enhancing opportunities. It also has a strong management team with an excellent record of growing shareholder value.

How do I buy Berkshire Hathaway stock directly?

To buy shares of Berkshire Hathaway, you must:

- Open a brokerage account.

- Fund your account.

- Open the order page.

- Fill in the order page, including selecting the right ticker (BRK.B for Berkshire Hathaway), the number of shares you want to purchase, and whether it's a market or limit order.

- Submit the purchase order.

Is it smart to buy Berkshire Hathaway stock?

It can be smart to buy Berkshire Hathaway stock. The company has historically outperformed the S&P 500 over the long term. For example, from 1965 through 2023, Berkshire delivered a 19.8% annualized gain, almost double the 10.2% return of the S&P 500.

The company is in a strong position to continue outperforming. It has an excellent management team, cash-generating operating businesses, a strong investment portfolio, and a fortress-like balance sheet. Those factors put it in an excellent position to grow its earnings and shareholder value in the future.