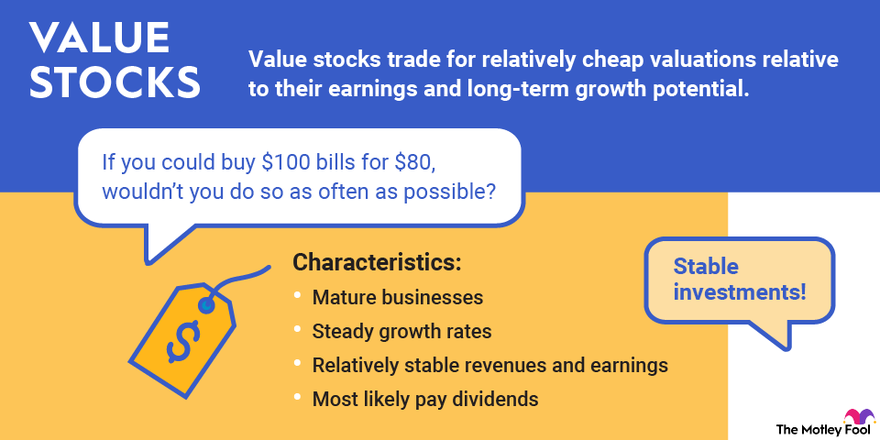

Value investors want to buy stocks for less than they're worth. If you could buy $100 bills for $80, wouldn't you do so as often as possible?

When the overall stock market drops, even high-quality companies with strong fundamentals see share prices fall. Plus, value stock companies tend to be well-established and less volatile compared to growth stock companies.

Here's an overview of value stocks, including some excellent beginner-friendly value stocks, and some key concepts and metrics that value investors should know.

Three best value stocks for beginners

Three best value stocks for beginners

Value stocks are publicly traded companies trading for relatively cheap valuations relative to their earnings and long-term growth potential.

Let's take a look at three excellent value stocks: Berkshire Hathaway (BRK.A -0.71%) (BRK.B -0.47%), Procter & Gamble (PG -2.74%), and General Motors (GM 3.4%). Then we'll dive into some of the metrics that can help you find the best value stock investments.

1. Berkshire Hathaway

Since CEO Warren Buffett took over in 1964, Berkshire Hathaway has grown into a conglomerate with more than 60 wholly owned businesses and a massive stock portfolio with more than four dozen different positions. Berkshire has steadily increased its book value and earnings power over time -- and it operates under the same business model that has led the stock to almost double the annualized return of the S&P 500 index for more than 55 years.

Buffett and his late business partner, Charlie Munger, kept large cash reserves to deploy when they spotted opportunity as part of their value investing strategy. In fact, Berkshire has been a net seller of stocks throughout 2024, a sign that Buffett believes the market is overvalued. Stocking up on dry powder is another smart strategy of value investors like Buffett, and it will likely pay off if stocks pull back.

2. Procter & Gamble

Consumer products manufacturer Procter & Gamble is the company behind such brands as Gillette, Tide, Downy, Crest, Febreze, and Bounty, but there are dozens more in its product portfolio. Through the success of its many brands, Procter & Gamble has been able to steadily add to its revenue over time and has become one of the most reliable dividend stocks in the market. The company is just one of 44 stocks to reach the coveted Dividend King status, having boosted its dividend for 68 consecutive years.

P&G is a classic example of a recession-resistant stock since demand for its products holds steady throughout stock market cycles. The consumer staples giant continues to post impressive growth. Share prices of P&G have steadily grown with an 18% year-to-date return as of December 2024. P&G's size, stability, and diversity of products make it a solid play for tough times.

3. General Motors

Valuation is arguably the most important test of a value stock as ultimately a value investor is looking to buy a stock that is worth more than it's priced for. As Warren Buffett has said, "Price is what you pay. Value is what you get."

On that account, one of the best value stocks around is General Motors. GM has been a leading player in the auto industry for a century and continues to be one of the world's largest automakers.

It currently trades at a price-to-earnings ratio of less than 6, a reflection of the low growth expectations that investors have. However, GM has continued to deliver solid results, and it should benefit from slowing growth in electric vehicles, even though it has a number of EVs on the market. The company recently announced that it would end its Cruise autonomous vehicle business, which had cost it billions of dollars; investors responded positively to the move.

As a value stock, GM is also able to aggressively repurchase stock to lift its earnings per share, one way value stocks can grow profits even without growing revenue.

What are value stocks?

What are value stocks?

Most stocks are classified as either value stocks or growth stocks. Generally speaking, a value stock trades for a cheaper price than its financial performance and fundamentals suggest it’s worth. A growth stock is a stock in a company expected to deliver above-average returns compared to its industry peers or the overall stock market.

Growth Stock

Some stocks have both attributes or fit in with average valuations or growth rates, so whether to call them value stocks depends on the number of pertinent characteristics they possess. Value stocks generally have the following characteristics:

- They typically are mature businesses.

- They have steady (but not spectacular) growth rates.

- They report relatively stable revenues and earnings.

- Most value stocks pay dividends, although this isn't a set-in-stone rule.

Some stocks easily fit into one category or the other. For example, package delivery giant FedEx (FDX -0.16%) is clearly a value stock that’s fallen out of favor with Wall Street due to some short-term challenges. Fast-moving Tesla (TSLA 0.15%) is an obvious example of a growth stock.

On the other hand, some stocks can fit into either category. For example, there's a case to be made either way for tech giants Apple (AAPL 0.67%) and Microsoft (MSFT 1.06%).

Regardless of the category of a stock, economic downturns present an opportunity for a value investor. The goal of value investing is to scoop up shares at a discount, and the best time to do so is when the entire stock market is on sale.

How to find value stocks

How to find value stocks

The point of value investing is to find companies trading at a discount to their intrinsic value, with the idea that they'll be likely to outperform the overall stock market over time. However, finding stocks that are undervalued is easier said than done.

That said, here are three of the best metrics to keep in your toolkit as you search for a bargain:

- P/E ratio: This is the best-known stock valuation metric -- and for a good reason. The price-to-earnings, or P/E, ratio can be a very useful tool for comparing valuations of companies in the same industry. To calculate it, simply divide a company's price per share by its past 12 months of earnings per share.

- PEG ratio: This is similar to the P/E ratio but adjusts to level the playing field between companies that might be growing at slightly different rates (thus, PEG, or price-to-earnings-to-growth, ratio). By dividing a company's P/E ratio by its annualized earnings growth rate, you get a more apples-to-apples comparison between different businesses.

- Price-to-book (P/B) ratio: Think of the book value as what would theoretically be left if a company stopped operations and sold all its assets. Calculating a company's share price as a multiple of its book value can help identify undervalued opportunities, and many value investors specifically look for opportunities to buy stocks trading for less than their book value.

Value investors

Value investors

Long-term investors can generally be classified into one of three groups:

- Value investors try to find stocks trading for less than their intrinsic value by applying fundamental analysis.

- Growth investors try to find stocks with the best long-term growth potential relative to their current valuations.

- Investors who take a blended approach do a little of each.

Warren Buffett is perhaps the best-known value investor of all time. From the point when he took control of Berkshire Hathaway in 1964 to the end of 2023, the S&P 500 has generated a total return of 31,223%. Berkshire's total return during the same period has been a staggering 4,384,748% (that's not a typo).

Although he isn't as well-known as Buffett, Benjamin Graham is often referred to as the father of modern value investing. His books, The Intelligent Investor and Securities Analysis, are must-reads for serious value investors. Graham was also Buffett's mentor.

Related investing topics

The power of value stocks

Don't underestimate the power of value stocks

While they might not be quite as thrilling as their growth stock counterparts, it's important to realize that value stocks can have just as much long-term potential as growth stocks, if not more. After all, a $1,000 investment in Berkshire Hathaway at the beginning of 1965 would be worth more than $28 million today. Finding companies that trade for less than they are truly worth is a time-tested investment style that can pay off tremendously.

FAQ

Value Stock FAQ

What is a value stock?

A value stock is one that trades for a cheaper price than its financial performance and fundamentals suggest it’s worth.

What are value stocks vs. growth stocks?

Value investing and growth investing are two different investing styles. Usually, value stocks present an opportunity to buy shares below their actual value, and growth stocks exhibit above-average revenue and earnings growth potential. Wall Street likes to neatly categorize stocks as either growth or value stocks. The truth is a bit more complicated since some stocks have elements of both value and growth. Nevertheless, there are important differences between growth and value stocks, and many investors prefer one style of investing over the other.

What are value stock ETFs?

An exchange-traded fund (ETF) that invests in value stocks uses specific criteria to find companies whose intrinsic values substantially exceed the market values implied by their stock prices. By investing in a wide range of undervalued companies, value stock ETFs confer instant portfolio diversification. Buying shares in a value stock ETF can be a safe and easy way to invest in companies in cyclical industries.

How do I start value investing?

Value investing requires a lot of research. You'll have to do your homework by going through many out-of-favor stocks to measure a company's intrinsic value and comparing that to its current stock price. Often, you'll have to look at dozens of companies before you find a single one that's a true value stock.