Microsoft (MSFT 1.06%) had humble beginnings. Childhood friends Bill Gates and Paul Allen formed the company in 1975 to develop programming languages for personal computers. Microsoft would create the operating system for IBM's (IBM 0.01%) first personal computer a few years later.

Microsoft has grown into one of the world's largest technology companies. The company organizes its operations into three segments:

- Productivity and Business Processes: This business segment features Office commercial and consumer products and cloud services, like its 365 Suite (i.e., OneDrive, Word, Outlook, Excel, and PowerPoint). It also includes its LinkedIn social media site.

- Intelligent Cloud: This operating unit includes server products and cloud services revenue, including its Azure platform.

- More Personal Computing: This business unit includes its Windows operating system, Xbox entertainment system, Bing search technology, and Surface product platform.

Microsoft's technology platform generates significant earnings and cash flow. That provides it with funds to invest in expanding its operations while returning cash to shareholders through dividends and share repurchases.

In recent years, the company has made several notable investments to drive future growth. In 2023, it closed an almost $70 billion deal for video game maker Activision to bolster its Xbox entertainment platform.

It also agreed to make a multiyear, multibillion-dollar investment in artificial intelligence (AI) company OpenAI to implement its technology into the company's Office, Azure, and Bing platforms.

Here's a step-by-step guide to buying Microsoft shares and some factors to consider before investing in the technology stock.

How to buy

How to buy Microsoft stock

To buy shares of Microsoft, you must have a brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms. Here's a step-by-step guide to buying Microsoft stock using the five-star-rated platform Fidelity.

Fidelity makes it easy to buy stocks. Its website also offers a video tutorial and a step-by-step guide. The screenshot below shows how to place a stock trade with Fidelity:

On this page, fill in all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The ticker symbol (MSFT for Microsoft).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the current market price.

Once you complete the order page, click the Place Order button at the bottom and become a Microsoft shareholder.

Should I invest?

Should I invest in Microsoft?

Before you buy Microsoft shares, you need to determine whether the company's stock is a good investment. Here are some reasons you might want to consider buying Microsoft stock:

- You want to own a small piece of one of the world's largest technology titans.

- You understand how Microsoft makes money.

- You want to own individual stocks.

- You've thoroughly researched Microsoft and plan to continue following the company.

- You think the company can continue growing its profits at an above-average pace.

- You want to invest in one of the most financially robust companies in the world.

- You think the Activision deal will help grow Microsoft's Xbox platform.

- You believe the company's investment in OpenAI will give it a competitive edge in the AI age.

- You don't need a lot of dividend income right now, but you believe Microsoft will continue increasing its payout at a healthy pace in the years to come.

- You believe Microsoft can outperform the S&P 500 over the long term.

- You use Microsoft's products and want to invest in the company making them.

- You understand the risks of investing in Microsoft, including that its shares could lose value.

Potential Microsoft investors must also consider why they might not want to buy shares. Here are some factors to contemplate:

- You're concerned about AI and unsure whether Microsoft's investment in OpenAI will create shareholder value.

- You don't like big tech companies and worry they're becoming too powerful.

- You're unsure whether Microsoft's acquisition of Activision will create value for shareholders.

- You need a higher-yielding dividend than Microsoft currently offers.

- You're unsure whether Microsoft can beat the S&P 500 over the long term.

- You don't want to own shares in a company founded by Bill Gates.

- You don't like Microsoft's products.

- You're younger and want to invest in a company earlier in its growth cycle than Microsoft, which has been around for almost a half-century.

Profitability

Is Microsoft profitable?

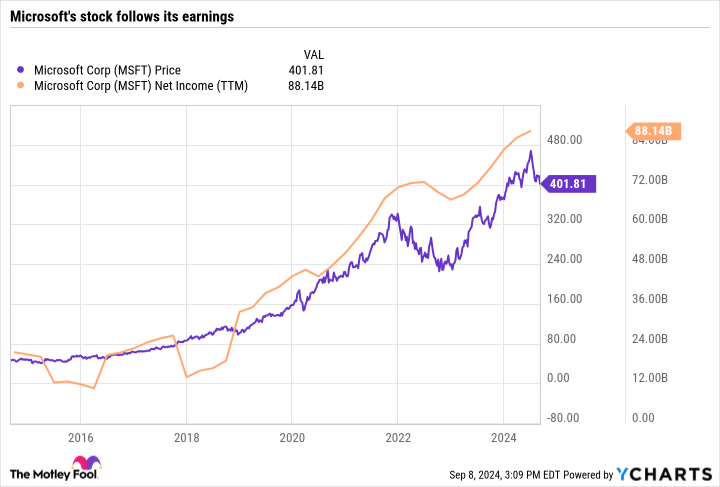

Profit growth helps drive stock price appreciation over the longer term. It's an ideal area for beginning investors to focus on before buying shares of any company.

Microsoft is enormously profitable. The technology giant generated $245.1 billion of revenue in its 2024 fiscal year (up 16%) and $109.4 billion in operating income (up 24%). The company has increased its earnings sharply over the years, helping drive strong stock price appreciation:

Microsoft's cloud services division was a notable growth driver at 19% revenue growth in its fiscal fourth quarter. And the company sees more growth ahead. It expects its revenue and earnings to be higher in its 2025 fiscal year, driven in part by its ability to capitalize on AI.

Dividends

Does Microsoft pay a dividend?

Microsoft started paying a dividend in 2003. However, it doesn't have a high dividend yield compared to other stocks. (Microsoft's yield was less than 0.8% in mid-2024 compared to below 1.5% for the S&P 500.)

Microsoft held the title of world's top dividend payer in 2023, paying out more than $20 billion in cash to its shareholders. The company has steadily increased its payout over the years, notching its 14th consecutive year of increasing the dividend in 2023, when it boosted the payout by 10%.

Microsoft is among the biggest dividend payers in the country.

ETF options

ETFs with exposure to Microsoft

Instead of actively buying shares of Microsoft directly, you can passively invest in the technology company through a fund holding its shares. Microsoft is one of the largest traded companies by market capitalization and is a widely held stock.

Microsoft is in several stock market indexes, including the Dow Jones Industrial Average and S&P 500 Index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Microsoft stock. According to ETF.com, 544 ETFs held 706.9 million shares of Microsoft as of mid-2024. The ETFs with the most shares were:

| Exchange-Traded Fund | Assets Under Management | Microsoft Shares Held | Fund Weighting | Position Ranking in Fund |

|---|---|---|---|---|

| SPDR S&P 500 ETF Trust (NYSEMKT:SPY) | $554.5 billion | 88.5 million | 6.5% | Second-largest |

| Invesco QQQ Trust (NYSEMKT:QQQ) | $276.8 billion | 55.7 million | 8.2% | Second-largest |

| iShares Core S&P 500 (NYSEMKT:IVV) | $511.6 billion | 81.7 million | 6.5% | Second-largest |

| Vanguard S&P 500 ETF (NYSEMKT:VOO) | $499.3 billion | 76.9 million | 6.7% | Second-largest |

| Vanguard Total Stock Market ETF (NYSEMKT:VTI) | $421.8 billion | 57.5 million | 5.8% | Second-largest |

As one of the world's largest companies by market cap, Microsoft carries a meaningful portfolio weighting in the biggest ETFs. Among the biggest ETFs, the Invesco QQQ Trust (NYSEMKT:QQQ) has the largest portfolio weighting to Microsoft, making it a potential option for investors seeking to gain exposure to Microsoft through a passive ETF investment.

Another relatively large ETF with an even greater portfolio weighting of Microsoft stock is the Technology Select Sector SPDR Fund (XLK 1.27%). Microsoft has a roughly 22% portfolio weighting in the fund, providing another possible way to gain meaningful exposure to Microsoft through a passive ETF investment.

Stock splits

Will Microsoft stock split?

As of mid-2024, Microsoft had yet to announce an upcoming stock split. However, the company has completed several stock splits over the years:

| Split Date | Stock Split | Pre-Split Price | Post-Split Price |

|---|---|---|---|

| February 2003 | 2-for-1 | $48.03 | $24.96 |

| March 1999 | 2-for-1 | $178.13 | $92.38 |

| February 1998 | 2-for-1 | $155.13 | $81.63 |

| December 1996 | 2-for-1 | $152.88 | $81.75 |

| May 1994 | 2-for-1 | $97.75 | $50.63 |

| June 1992 | 3-for-2 | $112.50 | $75.75 |

| June 1991 | 3-for-2 | $100.75 | $68.00 |

| April 1990 | 2-for-1 | $120.75 | $60.75 |

| September 1987 | 2-for-1 | $114.50 | $53.50 |

Microsoft had historically split its shares when they topped $100. However, the company has let its shares rise well past that level over the last two decades without a split (shares were over $400 in mid-2024). Although that makes it seem like Microsoft could split its stock at any time, the company might let shares continue to rise without another split.

Related investing topics

The bottom line on investing in Microsoft stock

Microsoft is a technology titan. The company has developed many of the productivity products we use every day. It continues to invest in developing innovative products to drive profit growth, so it could continue to be a winning stock for long-term investors.

However, that doesn't mean Microsoft stock is for everyone. Each investor must carefully consider whether it belongs in their portfolio.

FAQ

FAQ on investing in Microsoft stock

Can you buy Microsoft stock directly?

You can directly purchase shares of Microsoft in a brokerage account.

Are Microsoft shares a good investment?

Shares of Microsoft have historically been a good investment. As of mid-2024, the tech giant had delivered an average annual total return of 26.2% over the last decade. That's more than double the S&P 500's total return over the period (12.5%).

Does Bill Gates still own Microsoft stock?

As of mid-2024, Microsoft co-founder Bill Gates still owned about 1.3% of the company's outstanding shares, worth around $40 billion.

How many times has Microsoft stock split since 2000?

Microsoft has split its stock once since 2000. The tech giant completed a 2-for-1 stock split in 2003.

Matthew DiLallo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft, Vanguard Index Funds - Vanguard Total Stock Market ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.