Chances are good that if you are an investor, you have been investing in portfolio investment entities (PIEs) through mutual funds or exchange-traded funds (ETFs). Portfolio investment entities are essentially vehicles for pooling capital and diversifying risk via the involvement of multiple investors.

Overview

What is a portfolio investment entity?

A portfolio investment entity is a type of investment fund or vehicle that pools funds from multiple investors to invest in a diversified portfolio of assets. Mutual funds, ETFs, venture capital funds, and private equity funds are all examples of pooled funds that are investing in an array of assets. These assets can include stocks, bonds, real estate, private equity, alternative investments, and other financial instruments. The primary objective of a PIE is to provide investors with a means to achieve diversified exposure to a wide range of investment opportunities while mitigating individual risks. PIEs are typically managed by professional fund managers who make investment decisions on behalf of the investors.

Why PIEs are important

Why portfolio investment entities are important

1. Diversification and risk mitigation

One of the most significant benefits of investing in a PIE is diversification and access to assets that individuals might not otherwise enjoy. For example, if you want exposure to emerging markets like Thailand and India, you might have trouble gaining access to the companies and investments in the South Asian countries. Even if you are dead set on buying a ticket to Bangkok or New Delhi, there are several obstacles in your way. By pooling funds from multiple investors, however, a PIE can invest in a wide range of assets, spreading the risk across various sectors and industries. The diversification helps mitigate the impact of poor performance by any single investment, reducing the overall risk for investors.

2. Access to professional management

PIEs provide investors with access to professional fund managers who have the expertise and resources to conduct thorough research and analysis. In many cases, they have boots on the ground that are crucial to a fund's success. Take real estate investment trusts (REITs), for example, which provide investors with exposure to real estate via a fund rather than a direct investment in real estate. If an investor wants exposure to industrial real estate, for example, it would be difficult for them to buy a warehouse or plant, find and maintain the tenant, and find and maintain the warehouse or plant. But an industrial REIT will have people managing all facets of the investment, and investors can take advantage of the expertise in the industrial real estate space.

These managers make informed investment decisions, aiming to maximize returns and minimize risks. For individual investors, this access to professional management can be a significant advantage, especially if they lack the time or knowledge to manage their investments effectively.

3. Cost efficiency and tax management

Investors in the United States often choose PIEs for their tax advantages, among other benefits. One of the primary advantages is the ability to have investment income taxed at lower rates. For instance, capital gains from investments within PIEs are typically taxed at lower capital gains rates rather than higher ordinary income rates, reducing the overall tax burden on investors.

While mutual funds often pass capital gains to investors, ETFs tend to be more tax-efficient due to their in-kind creation and redemption processes, which minimize capital gains distributions. Most REIT dividends, in theory, would be considered ordinary income and will be taxed at personal income tax rates, just as if you were to own the property producing the rental income and yield. However, under the Tax Cuts and Jobs Act of 2017, as much as 20% of REIT dividends can qualify for a Section 199A deduction for qualified business income (QBI), effectively reducing the tax rate on those dividends.

Should you invest?

Should you consider investing in a PIE?

Here are some things you should always consider when investing in PIEs.

1. Assess your investment goals and risk tolerance

Before investing in a PIE, it is crucial for investors to assess their investment goals and risk tolerance. Understanding what you aim to achieve with your investments and how much risk you are willing to take on will help you choose the most suitable PIEs. For instance, an investor looking for steady income might opt for a PIE focused on bonds, while an investor seeking higher returns might choose a PIE that invests in stocks.

2. Research investment holdings

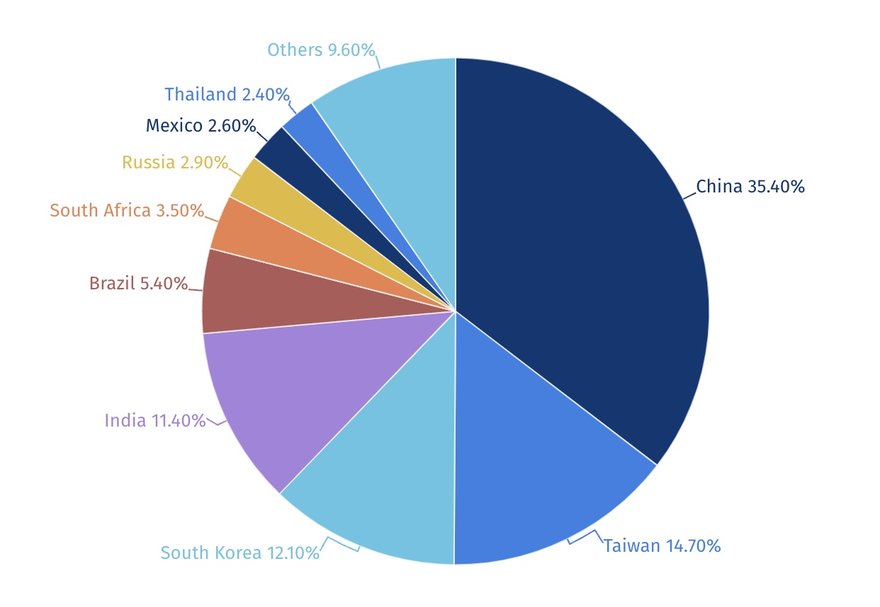

One of the advantages of PIEs is that they can hold multiple types of assets in multiple countries, which is great for diversification. You can get a great picture of the risks and advantages of any PIE based on their portfolio of holdings. Take the iShares MSCI Emerging Markets ETF (EEM 0.36%), for example, which invests across an array of industries such as information technology, finance, and consumer goods in emerging markets. Below is a breakdown of their emerging market exposure by country.

iShares MSCI Emerging Markets ETF global exposure

An investor might have a look at this and say to themselves, this is great, but it seems to focus heavily on Asia, and around 50% of the portfolio has exposure to Taiwan and China. Geopolitical tensions in Asia could have an adverse effect on 50% of the portfolio, and an investor who had these concerns might want to switch to a PIE that has more exposure to Latin America and India rather than China and Taiwan.

Related investing topics

Examples

Examples of PIES

Below is a table with examples of PIEs, including some funds you might already own.

| Name of PIE | Type of PIE |

|---|---|

| Vanguard Total Stock Market Index Fund (NASDAQMUTFUND:VTSAX) | Mutual Fund |

| iShares MSCI Emerging Markets ETF (NYSEMKT:EEM) | Exchange-Traded Fund (ETF) |

| Fidelity Real Estate Investment Portfolio (NASDAQMUTFUND:FRESX) | Real Estate Investment Trust (REIT) Mutual Fund |

| SPDR S&P 500 ETF Trust (NYSEMKT:SPY) | Exchange-Traded Fund (ETF) |

| T. Rowe Price Blue Chip Growth Fund (NASDAQMUTFUND:TRBCX) | Mutual Fund |

| Schwab Total Stock Market Index Fund (NASDAQMUTFUND:SWTSX) | Mutual Fund |

| Sequoia Capital | Venture Capital Fund (VC) |

| Blackstone Capital Partners | Private Equity Fund (PE) |

| American Funds Growth Fund of America (NASDAQMUTFUND:AGTHX) | Mutual Fund |

| Vanguard Real Estate ETF (NYSEMKT:VNQ) | Real Estate Investment Trust (REIT) ETF |