There are plenty of metrics to look at when choosing a new investment, especially stocks. Operating expenses should be part of your first glance since so much flows from how money is spent in a company. Read on to better understand what operating expenses are, what they aren't, and what they can tell you.

What are operating expenses?

Companies have all sorts of different expenses, including operating expenses. These are expenses that are incurred during normal operational activities. They're not expenses related to things like investing in projects or new equipment.

In short, if it's something the company has to do regularly to keep the core business running, it's probably an operating expense. You need production lines, service workers, customer service, and so forth to keep the cash flow coming. Your business can continue if you don't install another line on the factory floor or wait a year to expand your headquarters -- but you're toast if you can't keep the lights on.

Overview

What are operational activities?

Operating expenses are treated differently by the Internal Revenue Service, so it's important to understand what kinds of activities can generate them. To do this, you must first understand the business and the types of activities that are considered operational activities for the company. Operational activities can vary widely between industries and even between roles within industries.

For example, if a company sells cars that are pre-assembled, the primary operating activities of the company would all be related to selling those cars. Operating expenses might include salaries for the salespeople interacting with customers, marketers getting those customers in the door, secretaries answering telephone questions from the customers, and detailers cleaning the cars before showing them to customers.

This is different from the company that assembles the cars. The operating activities of the car manufacturer would include costs associated with assembling the car's doors, painting the car, putting wheels on the car, verifying that the cars meet specifications, and shipping the cars to dealerships to be sold.

Operating expenses vs. capex

Operating expenses vs. capital expenditures

Although operating expenses and capital expenditures (capex) sound like they're similar, or at least very closely related, they're actually two very different kinds of expenses that work together to help a company grow. Operating expenses, as stated above, cover all the day-to-day expenses that keeps a company running.

Capex, on the other hand, is all about investing in the company's future. These are expenses on assets that will remain in service for years. An example of a capital expenditure would be a new paint machine for a car manufacturing plant. Capex is generally deducted from corporate taxes over a number of years; operational expenses are taken in the year that it's spent.

Related investing topics

Why they matter

Why do operating expenses matter to investors?

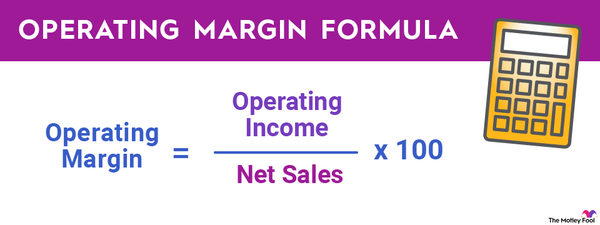

When you're choosing a stock, you're choosing a company to invest your money in. How that company handles its money is vital to how it will perform in the long term. It's that simple. Although there are other types of expenses to be mindful of, operating expenses tell a whole story by themselves.

If a company has been seeing increasing operating expenses without increased revenue, you're looking at a company that's likely taking on some bloat and needs to do some internal reviews. There's such a thing as cutting operating expenses too much, though, so you don't want them to be too small and too thin, or the customer experience may become an issue.

You can't compare operating expenses directly among companies, since every company operates a little differently, but you can look at operating expenses year by year, and even quarter by quarter if the business isn't seasonal, along with other expenses and various income streams to help see how efficient or inefficient the company is running vs. previous versions of itself.

Stock investors sometimes have to rely on their gut, but when it comes to operating expenses, things like customer reviews and product reliability testing can help you better understand what you're getting with those operating expenses.