The national average wage index (NAWI) influences a range of federal benefits, including Social Security retirement and disability payments. Learn how NAWI works and the calculations NAWI influences to determine your retirement income below.

How it's used

How NAWI is used

The national average wage index, or NAWI, is the arithmetic mean of salaries earned in the U.S. for a given year. The Social Security Administration (SSA) calculates NAWI annually. NAWI values across all years are collectively called the national average wage indexing series.

The SSA uses NAWI values and their year-to-year changes in several ways:

- To calculate Social Security benefits.

- To set the annual maximum earnings taxable by Social Security.

- To set income caps for Social Security beneficiaries who receive benefits before normal retirement age.

- To set the earnings amount needed to earn Social Security credits.

- For self-employed workers, farm workers, domestic employees, and election workers only, to set the earnings threshold for Social Security coverage.

- To define substantial gainful activity, relevant for determining disability benefits eligibility.

Social Security benefits

NAWI and Social Security benefits

NAWI affects most U.S. workers via its role in calculating Social Security retirement benefits. The SSA uses NAWI to make inflation adjustments to a worker's historic earnings. The goal is to convert the earnings to values that reflect their purchasing power in current dollars.

As an example, the NAWI in 1953 was $3,139.44. The 2023 value was $66,621.80. These are wildly different numbers, but both supported roughly the same quality of life in their respective years. Indexing wage history using the NAWI ensures that Social Security benefits are appropriate given the inflation experienced over a beneficiary's lifetime.

How NAWI is determined

How NAWI is determined

The SSA calculates NAWI annually from collected wage data. The administration determines average wages yearly by analyzing earnings subject to federal income taxes and contributions to deferred compensation plans. The average is then compared to the prior year. The percentage difference is added to the preceding year's NAWI to calculate the current year's value.

To demonstrate, the 2023 NAWI was $63,795.13. If the average wage rises 4.8%, the 2024 NAWI would be 4.8% higher than $63,795.13 or $66,857.30.

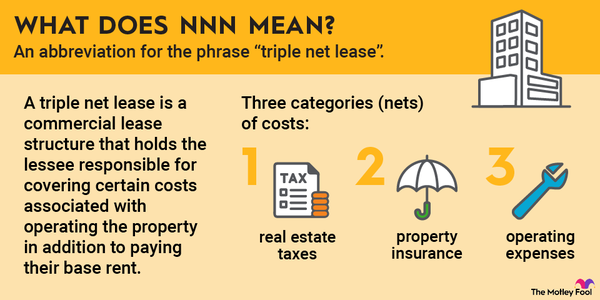

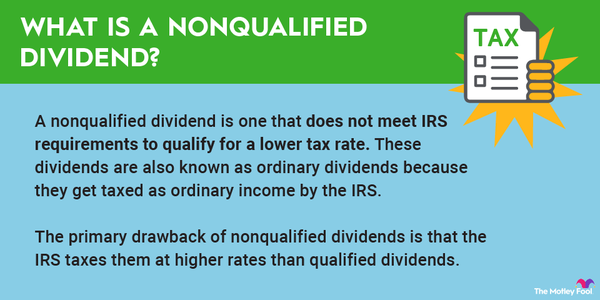

Related investing topics

NAWI and AIME

NAWI and average indexed monthly earnings (AIME)

The SSA determines a worker's basic retirement benefit -- called the primary insurance amount -- from the worker's average indexed monthly earnings (AIME). AIME is derived from wage indexing, using the NAWI. The steps are:

- Determine the base year for indexing.

- Use NAWI values to calculate indexing factors for each year before the base year.

- Apply indexing factors to all annual wages.

- Sum the indexed earnings from the highest-paid 35 years.

- Divide the sum by the number of months in 35 years.

Determine the base year. Indexing begins with the worker's earnings from two years before Social Security eligibility. Social Security retirement benefits are available at 62, so the base year for indexing is the individual's 60th year. For a beneficiary who turned 62 in 2024, the base year is 2022.

Calculate indexing factors. For each year before the base year, the SSA calculates an indexing factor. The indexing factor is the base year NAWI divided by that year's NAWI. If the base year is 2022, for example, the indexing factor for 2021 is 2022 NAWI divided by 2021 NAWI.

Using actual NAWI values, this calculation is $63,795.13 divided by $60,575.07. That equates to an indexing factor of 1.0532.

Apply indexing factors. The 1.0532 value is multiplied by this worker's actual 2021 wages. The indexing factor is higher than one, so the indexed -- or inflation-adjusted -- wages will be higher than face value. The SSA repeats this calculation for all years of the beneficiary's earnings.

Sum the indexed earnings. The indexed earnings from the worker's highest-paid 35 years are summed. Values from lower-income years are disregarded.

Divide by 420. The SSA then converts the 35-year total indexed earnings into a monthly value. The divisor of 420 equals the number of months in 35 years.

The resulting value is the worker's AIME. SSA then applies a different formula to AIME to calculate the worker's Social Security benefit.