When you own or invest in a company that produces things, it's important to be able to see just how much it costs to produce each item, as well as where efficiencies can be improved. Metrics like the minimum efficient scale (MES) can make it easier to determine if you're at peak efficiency.

Overview

What is minimum efficient scale?

When you look at the cost of producing an item in a factory, it's never simply a single point in a vast empty ocean. Instead, these costs exist on scales. As inputs change, so do the costs of the outputs -- the products, if you will.

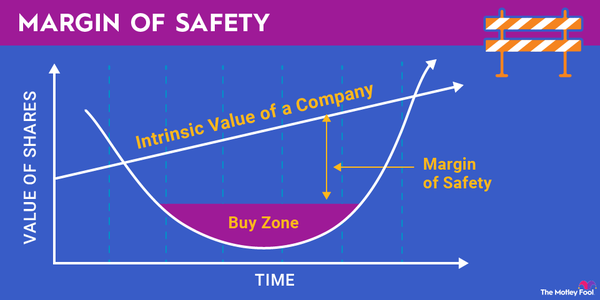

The minimum efficient scale is part of the long-run average cost curve and represents the point at which goods can be produced as cheaply and efficiently as possible. It also marks the point where economies of scale are most effective.

Long-run average cost curve

Minimum efficient scale and the long-run average cost curve

To really understand the minimum efficient scale, you have to understand the long-run average cost curve since the minimum efficient scale is part of this larger curve. The long-run average cost curve shows the cost of producing a product over time, starting from when the product was produced minimally to a point where it has a high level of production.

At the beginning of the long-run average cost curve, the cost per unit is very high, and as the product is able to scale up, it eventually starts to drop. When it hits the bottom of the cost curve, or the point at which it can't be produced more efficiently or for less money, it's reached the minimum efficient scale. Unfortunately, due to things like added layers of bureaucracy, more labor, and other expansion costs, continuing to produce the product beyond this point tends to turn the curve upward again.

Diseconomies of scale

Minimum efficient scale and diseconomies of scale

When the long-run average cost curve turns upward after the minimum efficient scale is achieved, it's due to the production cost of the product rising. Ironically, this is often the result of the expansion that allowed the company to reach the minimum efficient scale to begin with.

However, more workers need more bosses, more bosses mean more bureaucracy, more bureaucracy means more offices, and all of these new people mean less efficient communication and higher overhead costs per item that cannot be avoided. This is the point where you've entered the diseconomies of scale, where producing more is actually costing you more than when you produced fewer items.

Related investing topics

Why it matters

Why minimum efficient scale matters to investors

Investors who are choosing to buy stocks in specific companies, especially those that manufacture goods, should have at least a passing understanding of minimum efficient scale. This metric tells you about how much production is realistic for your company at its optimum efficiency level. When combined with the long-run average cost curve, minimum efficient scale can help you better understand where and why money is being spent as your company scales up.

It may also be of some interest to bond holders, if they're buying bonds in companies that are manufacturers. Since companies can use bond sales to raise funds for expansion and experience a loss in efficiency because of the expansion, knowing that this is the natural order of things may make you less nervous when it happens.

Either way, because it's practically a given stage for manufacturing companies, understanding minimum efficient scale and what it means in relation to the manufacturing process can help you better choose when to jump into an investment, and what to expect as the company grows.