Liberty Bonds were not the first bonds issued to fuel an American war, but they were the first to encourage massive public participation in support of a war. Although mostly held as collector's items today, Liberty Bonds influenced the modern financial and geopolitical landscape and have an important place in American history.

What are they?

What are Liberty Bonds?

Liberty Bonds are a type of war bond issued by the U.S. government during World War I. First introduced in 1917, these bonds allowed citizens to lend money to the government, which used the funds to cover war expenses, such as supplies, equipment, and soldiers' salaries. By buying Liberty Bonds, Americans helped fund the war effort while earning interest on their investments.

The bonds introduced financial securities to the masses and were touted as a patriotic duty rather than just an investment. They were an important way for the U.S. to raise money quickly and were marketed heavily to the public through posters, rallies, and celebrity endorsements.

How they worked

How did Liberty Bonds work?

When someone bought a bond, they were essentially lending money to the U.S. government. In return, the government promised to pay them back the amount they invested (called the principal) plus interest after a set period of time. Here's how it worked:

- You purchased a bond: Say you bought a bond for $50. Liberty Bonds were often sold at a discount relative to its face value.

- Interest accrued: Over time, you'd earn interest, typically between 3.5% to 4.5%, depending on the bond series. Some Liberty Bonds paid semiannual interest payments known as coupons. Alternatively, those that sold at a discount made a one-time interest payment once the bond matured.

- The bond reached maturity: After the bond matured (usually 10 to 30 years later), the government would repay the $50 you originally invested. If you purchased the bond at a discount from its face value, you'd also receive the interest you earned over the years.

Their importance

Why were Liberty Bonds important?

Liberty Bonds weren't just a way to raise money -- they also brought the American people together during World War I. The government launched a massive ad campaign encouraging people to see buying these bonds as their patriotic duty. Even if someone couldn't fight on the battlefield, buying a Liberty Bond was a way to feel like they were contributing directly to the war effort.

For many everyday Americans, this was their first time investing in anything. Before this, it was mostly wealthier citizens who bought stocks and bonds, but Liberty Bonds opened up the world of government securities to the average person. For some, it was their first taste of investing, making them feel more connected to the country's success during the war.

Liberty Bonds introduced the concept of government bonds as a safe, accessible investment to the average American. Today, U.S. Treasuries are often heralded as "risk-free" investments.

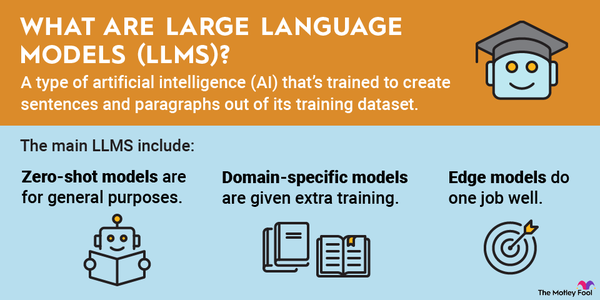

Related investing topics

Their legacy

Liberty Bonds' legacy: Series EE savings bonds

Liberty Bonds were influential in the development of savings bonds, specifically Series EE savings bonds, which are still available today. Introduced in 1980, Series EE bonds were created as low-risk, government-backed investment tools to fund government operations and services.

After the Sept. 11, 2001, attacks, some limited edition Series EE savings bonds were issued as "Patriot Bonds" in support of anti-terrorism efforts. Series EE savings bonds offer a fixed interest rate. If you hold them for at least 20 years, the U.S. Treasury guarantees they'll double in value. They offer small-scale investors the same safe long-term savings product as Liberty Bonds did over a century ago.