A stock float is a little-understood term often overlooked by beginning investors. It simply refers to the number or percentage of shares that are available for public investors to buy and sell. Although it may sound like more noise that's far less important than many other metrics used to value a stock, float can be a critical piece of information for investors. We'll dig into stock floats here and tell you why they're information that you might find useful.

Overview

What is a stock float?

A stock float is simply the number or percentage of shares that are available to public investors. Three classes of stock aren't included in the float:

- Stocks held by company insiders.

- Stocks kept on a company's books.

- Restricted stock units (RSUs) that aren't available for sale.

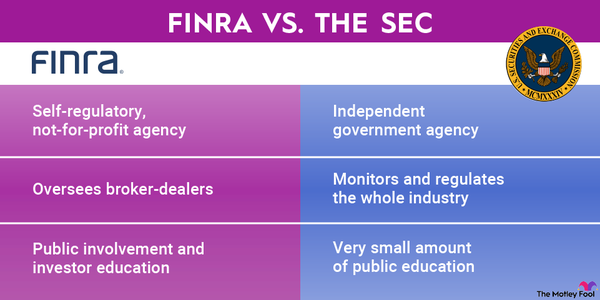

Although technically not part of a stock float, you should also keep an eye on other investors who trigger reporting requirements to the U.S. Securities and Exchange Commission (SEC) by acquiring more than 5% of outstanding shares or who have held a particular stock for a lengthy period.

Investors also should be aware of the differences among related terms. Authorized shares, for example, refer to how many shares of stock a company could issue if needed. The number of authorized shares is always greater than the number of outstanding shares, which provides the total number of existing shares, including those held by insiders, the company, or restricted stock owners. In turn, the number of outstanding shares is always greater than the float since the float doesn't include shares held by insiders, the company, or restricted stock owners.

When considering buying stock from an initial public offering (IPO), investors shouldn't assume that a newly public company will float all its stock. When Robinhood (HOOD 3.29%) went public in 2021, for example, the company only floated about 7% of its shares.

Newly public companies often begin with a smaller float because the market may not be ready to absorb a large number of outstanding shares. Insiders may also not want to part with their shares during an IPO, or the company may simply want to generate more enthusiasm for a stock by limiting the supply.

Stock float and volatility

Stock float and volatility

Stocks with a smaller float tend to be more volatile. A stock with a small float can become even more volatile during a short squeeze, when its price moves higher and short sellers need to cover their positions. As more short-sellers buy the stock to cover their positions, the stock price rises, meaning more short-sellers face losses if they don't buy the stock.

The relationship was highlighted in early 2021 during an epic short squeeze of GameStop (GME 3.7%) stock. The troubled company had been repurchasing modest amounts of its own stock for the past two years, reducing the float. But it also had been closing stores, and short-sellers were circling its stock; at one point, roughly 140% of its float had been sold short.

Related investing topics

Related investing topics

Meanwhile, members of a Reddit (RDDT 0.98%) community devoted to meme stocks and risky stock transactions speculated that GameStop's reduced float made it ripe for a short squeeze and began buying the stock, sending its price skyrocketing and forcing short-sellers to scramble. Bloomberg reported later in January that short sellers lost $6 billion in less than a month as the company's shares soared 285%.