If you've read or watched enough financial media, you've likely come across the term "falling knife" before. The term falling knife illustrates a certain kind of stock that is best avoided -- using colorful imagery that means what you might think it does.

What is it?

What is a falling knife, exactly?

A falling knife is a stock that is falling and investors think will head lower. Generally, the stock has fallen sharply in a short period of time. As the term implies, a falling knife is dangerous because it could "cut" investors who buy the stock while it is falling.

Stock

How to identify

How do you identify a falling knife?

Investors use the term falling knife regularly, but there is no surefire way to identify a stock that is falling and heading lower. No one knows what the stock market or an individual stock will do in the future. However, there are some signs that a falling stock could keep heading lower.

- The business model seems fundamentally broken or unsustainable. Stocks fall all the time, but shares of a falling knife are likely to keep dropping if a company can't deliver what investors expect.

- There are signs of malfeasance, such as an accounting scandal. Signs of something like this could include a delay in 10-K or 10-Q filings or the surprise resignation of C-suite executives, like the CFO.

- There's chronic underperformance. This could include a company that regularly misses its own guidance or can't seem to accurately forecast its business due to external headwinds or internal challenges.

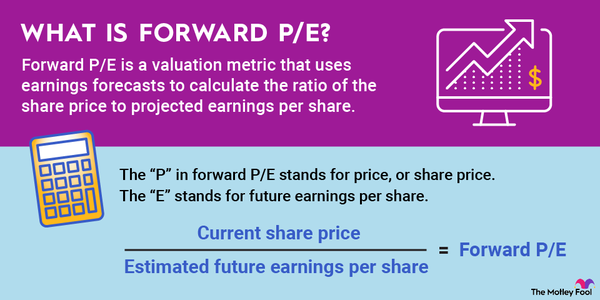

- Valuation can also play a role. A high-priced stock can easily become a falling knife due to a simple earnings miss or weak guidance.

Ultimately, designating a stock as a falling knife is a matter of opinion. However, there are indicators that will lead investors to call a certain kind of stock a falling knife, especially when it seems worse news is yet to come.

Opportunity?

Can a falling knife become a buying opportunity?

Being a falling knife stock isn't a permanent condition. It can change depending on a stock's performance, the overall direction of the market, and business conditions.

Much like there's no exact science for determining when a stock is a falling knife, it's debatable when it is no longer too sharp to catch.

One example is when a stock rises even though it releases a disappointing earnings report or some other kind of bad news. That's a sign that a stock has already capitulated or that there's been sufficient selling and traders have realized losses.

A fundamental improvement in the business can also turn a falling knife into a buying opportunity, or something like a change in management or even macro-level news can reinvigorate interest in the stock.

Example

What's an example of a falling knife?

One example of a falling knife -- and a stock that's fallen substantially from its peak -- is Beyond Meat (BYND -2.49%). Shares of the plant-based meat producer originally soared after its initial public offering (IPO) in May 2019. Revenue was skyrocketing at the time, and many investors believed its alternative meat would be the next big thing.

However, a few years later, that seems to no longer be the case as the stock has plunged, with revenue falling over several quarters and the company posting wide losses. The plant-based revolution Beyond Meat had hoped for never materialized, and consumers seemed to have moved on from its products.

Related investing topics

In the first quarter of 2024, the company reported an 18% decline to $75.6 million and an operating loss of $53.5 million. Those numbers seem to indicate that Beyond Meat is beyond saving. While the stock is arguably beyond its falling knife phase after plunging through 2021 and 2022, it continues to plumb new depths due to the overall weakness in the business.

Despite promises of a turnaround, Beyond Meat shows little sign of any potential for a comeback. It remains a falling knife and offers a good example of the kind of business that can burn investors who try to buy it on the way down.