Construction loans help property owners finance development projects. Let's explore how construction loans work and how to qualify for one. We'll also summarize the loan process and share four alternative forms of financing.

What are they?

Understanding construction loans

A construction loan is short-term financing that typically funds the construction of a new home on previously undeveloped land. The loan is approved for an amount sufficient to cover construction costs, less the borrower's downpayment. Funds are then borrowed as needed to pay contractor invoices. Lenders often pay contractors directly.

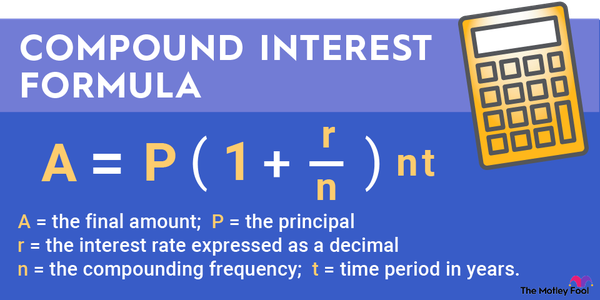

These are usually interest-only loans with variable rates. Borrowers pay interest on the amount outstanding rather than the total approved loan amount.

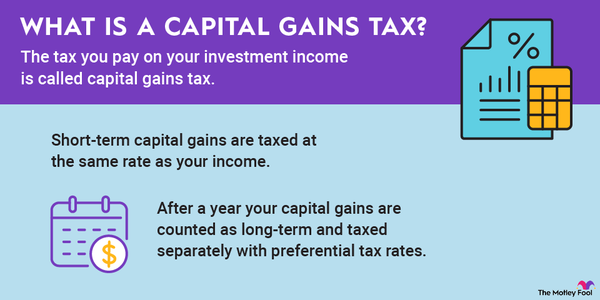

The interest rate on a construction loan will be higher than what's available on a fixed-rate mortgage. This is because a mortgage can use a finished home as collateral, but there is no structure available to collateralize a construction loan. The lender may take the land as collateral, but only if the land is not financed by another lender.

Construction loan types

Construction loan types

There are two common types of construction loans.

- Standalone construction loans, or construction-only loans, pay the builder's invoices while construction is in process. Usually, the borrower must repay the debt once the work is complete or within 18 months. The payoff can be in cash or by way of refinancing. A standalone construction loan is a good option for property owners who plan on selling once the project is finished.

- Construction-to-permanent loans automatically convert into a fixed-rate mortgage when construction ends. This streamlines the process for borrowers because there is no loan closing or payoff to manage. A converting construction loan is preferred when the borrower intends to live in or use the newly built structure.

Qualification

Qualification requirements and process

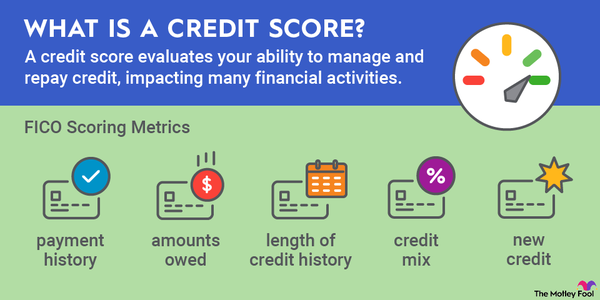

FHA construction loans, which are financed by the Federal Housing Administration, specify these requirements:

- Downpayment of 3.5% to 10%.

- Credit score of 500 or higher.

- Debt-to-income ratio below 43%.

Uninsured loans will require a higher down payment -- usually 20% or 25% -- and a higher credit score. However, an uninsured loan may offer more flexibility in the amount available. The FHA caps construction loan amounts based on regional housing costs. These loan amount limits can range from about $470,000 to over $1 million.

Borrowers can quantify the funding available to them by requesting a pre-approval letter. The pre-approval will include downpayment requirements, loan amount, interest rate, and loan term, all of which are subject to change before the loan funds.

With a pre-approval in hand, borrowers can collaborate with their builder to solidify their budget and construction plans. Documents required before loan closing usually include:

- Loan application. The application documents the borrower's income and assets. The borrower may need to provide W-2s, tax returns, and bank statements.

- Copy of construction contract. The contract should detail the scope and the builder's responsibilities.

- Cost estimate and timeline for the project. The builder's estimate justifies the loan amount.

- Building plans and specifications. Plans should be complete and support the cost estimate.

- Business documents from the contractor. The lender will require proof of insurance, licensing, and financial solvency from the builder.

Once the loan closes, the contractor works with the lender to satisfy the invoicing requirements. Usually, inspections are required to ensure work progress before funds are released.

Related investing topics

Alternatives

Alternatives to construction loans

A construction loan is not the only way to finance residential or commercial construction. Alternatives include home equity financing, unsecured personal loans, secured personal loans, or cash.

Home equity financing. Borrowers with equity in another property could use a home equity loan or line of credit to finance construction. Home equity financing will carry a lower interest rate than construction financing.

Unsecured personal loan. Borrowers with good credit and net worth may opt for an unsecured personal loan. This is a more expensive option, but approval may be easier -- particularly if the borrower uses an existing banking relationship.

Secured personal loan. High net-worth individuals may have access to a personal line of credit secured by an investment portfolio. The interest rate will be lower here vs. an unsecured loan. However, if stocks are used as collateral, there is potential for a margin call.

Cash. Cash savings can be the least expensive financing option for construction, although it's not an option for most.