Bifurcation is a term used to describe the division of something into two distinct parts. In finance, business, and investment, bifurcation plays a critical role in understanding market behaviors, strategic planning, and risk management.

Overview

What is bifurcation?

Bifurcation can occur in numerous contexts, including mathematics, where it describes changes in the structure of a system as a parameter is varied.

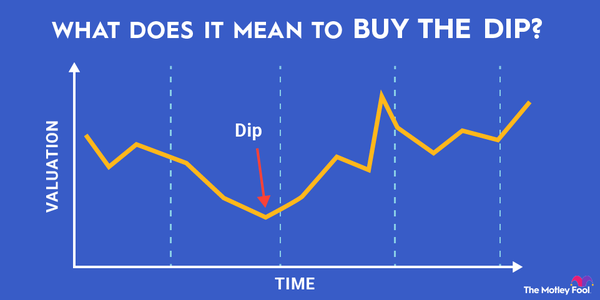

Think of bifurcation as a fork in the road, supported by certain sets of data, in which you can choose one direction or another. The direction you choose will have consequences, so understanding your bifurcation points is essential.

Bifurcation in finance and business refers to the splitting of assets, liabilities, or market trends into two separate and distinct entities. This can happen in various scenarios, such as during a corporate restructure, market split, or when investment strategies diverge significantly due to changes in economic conditions. In the simplest of terms, bifurcation marks a point where a single path divides, leading to different outcomes or directions.

Importance in business

The importance of bifurcation in the business world

Bifurcation and bifurcation points can help point people in the right direction, particularly in business and finance. They are typically used for the following:

Strategic financial planning

When companies or investors anticipate bifurcation points, they can prepare for potential shifts in market conditions or business environments. This preparation might involve diversifying investments, restructuring debt, or reallocating resources to mitigate risks and capitalize on new opportunities.

For example, during the 2008 financial crisis, the bifurcation in the housing market and mortgage-backed securities led to a significant divergence between stable and high-risk financial entities. Those who recognized the signs of bifurcation early could adjust their strategies and go with a safer bet.

Market analysis and risk management

In the automobile industry, market bifurcation can be observed with the rise of electric vehicles (EVs) and autonomous vehicles (AVs). Here is where you can see two paths to follow for the industry.

One path could see the dominance of EVs driven by environmental concerns and government incentives, benefiting companies like Tesla (TSLA 0.15%), while traditional car manufacturers may struggle or need to adapt. The other path involves the rapid adoption of AVs, leading to new business models such as autonomous ride-hailing services, impacting companies specializing in self-driving technology like Waymo. This bifurcation point is really important for market analysis and risk assessment, as recognizing these potential paths allows companies to prepare and adapt their strategies accordingly.

Decision-making in business and investments

Bifurcation points are pivotal in decision-making processes. When businesses anticipate a bifurcation, they can make informed decisions about expansion, mergers, or divestitures. For example, a company might decide to split its operations into two distinct units to better focus on different market segments, thereby optimizing performance and growth potential. This has happened with several companies, such as General Electric (GE 0.28%) and Johnson and Johnson (JNJ -0.37%).

When looking at investments, recognizing bifurcation and bifurcation points can lead to better portfolio management. Investors might choose to bifurcate their investment strategies by allocating funds to both high-risk and low-risk assets, balancing potential returns with security. For example, if an investor sees a potential economic downturn on the horizon, they might move some of their money from high-risk tech stocks to safer government bonds like U.S. Treasuries.

How to use it

How to use bifurcation in practice

1. Identify bifurcation points

To effectively use bifurcation, you need to spot key turning points in a system. In finance, this means watching market trends, economic indicators, and company performance to predict big changes that might be on the horizon. For example, if an investor keeps an eye on interest rates and inflation, they can better predict when the bond and stock markets might shift. Just like checking the weather forecast before deciding whether to bring an umbrella or snowplow, keeping tabs on these indicators helps investors prepare for market changes.

Another example can be seen in the energy sector with the adoption of renewable energy sources versus continued reliance on fossil fuels. Again, we can see two paths here.

One path could see increased investment in solar, wind, and other renewable energies due to environmental policies and technological advancements. The other path might involve new methods of fossil fuel extraction and use, driven by economic factors and technological improvements in efficiency and emissions reduction.

2. Make strategic adjustments

After spotting these key turning points, businesses and investors can tweak their strategies to stay ahead. This might mean shifting resources, changing up investments, or restructuring how they operate. For example, in the technology sector, bifurcation can occur with the advancement of artificial intelligence (AI) and automation.

Many companies face a choice regarding how they would like to implement customer service. Companies might face a split between investing heavily in AI-driven processes to enhance efficiency and reduce labor costs versus focusing on human-centric services that focus much more on personalized customer experiences. It's possible that the more AI becomes involved in customer service, the more humans might prefer speaking with other real certified homo sapiens rather than bots only.

3. Continue to monitor and adapt your strategy

By making adaptations based on real-time information, businesses and investors can better handle changes and reduce risks. One example of this can be seen in the retail sector with the shift toward e-commerce versus traditional brick-and-mortar stores. Retailers need to monitor consumer behavior and technological trends to determine whether to invest more in online platforms or enhance their physical store presence.

Related investing topics

Example

Hewlett-Packard and HPE: A case of bifurcation gone right

In 2015, Hewlett-Packard (HPQ 2.2%) decided to split into two separate companies -- HP Inc. and Hewlett Packard Enterprise (HPE 4.72%) -- to better address different business focuses and market demands. This move, driven by market pressures and the need for more transparent and direct operational strategies, aimed to enhance shareholder value. HP Inc. would handle personal computing and printing for consumers and small businesses, while HPE would focus on enterprise products like servers and storage.

Since the split in 2015, HP Inc.'s stock price has risen by about 168%, while Hewlett Packard Enterprise's stock price increased by 135%.