When you think about investing in bonds, you may immediately think of Treasury bonds, but they're not all the available options. Another great option is agency bonds, which are also tied to the U.S. government, although not in the same way. Read on to learn more about this investment vehicle.

What are they?

What is an agency bond?

An agency bond is a debt issued by either a federal government department or a government-sponsored agency like Freddie Mac or Fannie Mae. They don't include bonds issued by the Treasury department, and they pay different rates than Treasury bonds.

Because not all agency bonds are issued by the government, they're not all backed by the full faith and credit of the United States, meaning that some are riskier than others. They're still pretty low-risk overall, though, and very easy to acquire in general.

Types of agency bonds

Types of agency bonds

There are two main types of agency bonds: federal government agency bonds and government-sponsored enterprise (GSE) bonds. Each comes from exactly where you'd think. Federal government agency bonds are from the government, and government-sponsored enterprise bonds come from GSEs.

Here are some examples of agencies and GSEs that issue bonds:

Federal government agency bonds

These are issued by government agencies, excluding the U.S. Treasury, which issues its own bonds. Agencies that issue bonds include:

- Federal Housing Administration (FHA).

- Small Business Administration (SBA).

- Government National Mortgage Association (GNMA).

Government-sponsored enterprise bonds

Government-sponsored enterprises are not government departments but are subject to government oversight and may have some government support. Because of this, they are not backed by the full faith and credit of the U.S. government and may carry a bit more risk. GSE bonds come from places like:

- Federal National Mortgage Association (Fannie Mae).

- Federal Home Loan Mortgage (Freddie Mac).

- Federal Farm Credit Banks Funding Corporation.

- Federal Home Loan Bank.

- Tennessee Valley Authority (TVA).

Advantages

Advantages of agency bonds

Agency bonds are generally very solid investments because of their proximity to the United States government. Even GSE bonds are much safer investments than many other vehicles, although they are not officially backed by the U.S. government in the same way as other agency bonds.

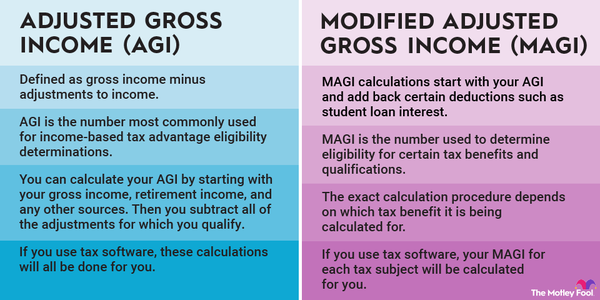

Agency bonds may carry slightly higher interest rates due to the slightly increased risks involved, but they also generally offer another benefit -- for many agency bonds (check yours before investing), the interest is exempt from local and state taxes, which can save you a lot of money depending on how much you're investing and where you live.

Related investing topics

Why they matter

Why agency bonds matter to investors

For investors, agency bonds are a great way to balance a stock portfolio. They bring stability and safety to a portfolio that might be at risk of severe highs and lows, depending on an investor's particular risk tolerance. With any fixed-rate agency bond, as long as you hold the bond, you know exactly what to expect from it and how much it will return, giving you a baseline for building an investment or retirement plan.

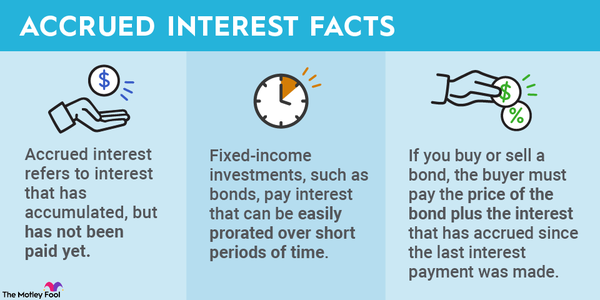

In addition to simply holding them to maturation, you can also buy and sell agency bonds on the secondary bond market. This can be a great way to make extra money on your good investments if the bonds you choose end up being in high demand or interest rates drop after you have locked in your bonds. You may be able to ask a premium for those higher-rate bonds in a lower-interest-rate environment, for example, depending on just how much time is left on them and how much rates have fallen.