If you want to know how to invest in American Express, you've come to the right place. American Express is a bank that is mainly known for offering premium credit cards but is sometimes criticized for its high fees charged to merchants. This sometimes leads smaller businesses to refuse it. American Express generally caters to an exclusive and wealthier clientele, and with the ranks of the global wealthy continuing to increase, it could be a smart investment play.

How to invest

How do you invest in American Express?

To invest in American Express (AXP -0.4%), you should first open an online brokerage account with an online platform like TD Ameritrade. Decide on your budget, make sure you don't invest more than you can afford to lose, and research the company's performance. If you prefer a diversified approach to investing in stock, consider investing in an exchange-traded fund (ETF) that includes American Express. Once you're ready, place an order through your brokerage account to buy American Express stock or an ETF that includes it.

Step 1: Open a brokerage account

If you want some exposure to American Express, you'll need to start by establishing a brokerage account. Popular brokers include TD Ameritrade, Fidelity, and E*TRADE.

Things you should look out for:

Commission-free trading: These days, many brokerages will offer commission-free or ultra-low commission trades on their platforms. Companies like Robinhood (HOOD 3.29%) pioneered this approach, and it has trickled down to a huge swathe of brokerages. This will allow you to save money on trading fees, which can be a huge boon if you are practicing and are a novice trader.

A solid and easy UX: Make sure that you choose a brokerage that you understand how to navigate. Even if you can track the market via complicated quadratic equations in your head, it's useless if you can't input the relevant information to make a trade with ease. Try to select something that your child or nephew/niece would be able to use.

Additional tools and resources: Many brokerages will offer additional tools and resources that can help educate traders about how to invest, what to invest in, and news about market trends. In the world of finance, knowledge is power, and the more data and educational materials you can absorb, the better equipped you will be to do battle on the trading floor and win!

Stock

Step 2: Determine your investment budget

Once you have your brokerage account firing on all cylinders and are ready to pull the trigger, stop. You need to make sure there are a few more boxes ticked off before you invest in American Express. The biggest question is, how much do you want to invest?

Concepts that you might want to consider are the amount you are comfortable risking as well as embracing portfolio diversification. Make sure that you are careful with how much you're investing and when you'll invest. Don't invest what you can't afford to lose, and consider diversifying into other stocks and assets. You could consider investing in other companies related to payments, different stocks like bank stocks, or another asset class altogether.

Step 3: Do your research

Research American Express' financial health and market positioning.

What are American Express' revenue streams?

American Express makes money primarily through transaction fees on its payment network and credit card services. Although it is indeed a bank, its revenue derived from traditional banking services is minimal. Every time a customer uses an Amex card for a purchase, the company earns a percentage of the transaction from merchants, which is typically higher than competitors like Visa (V -0.59%) or Mastercard (MA -1.81%). On top of that, American Express also earns interest and fees from credit cardholders, including late payment fees and annual membership fees.

What will drive the future growth of American Express?

American Express is benefiting from two major growth drivers: the global shift toward digital/mobile payments and its strong loyalty programs. As more consumers and businesses move away from cash to digital transactions, American Express is well positioned to capitalize on this trend. Amex's rewards programs, particularly for travel and dining, have attracted a loyal customer base, helping the company maintain high customer retention rates. With travel rebounding after the pandemic, Amex saw a surge in customers using its platinum card to earn rewards on flights and hotels. Many cardholders stick with Amex for the travel perks alone, leading to some of the strongest brand loyalty in the business.

Are there risks to the credit card industry or American Express specifically?

Like any financial company, American Express faces risks from economic downturns. In tough economic times, consumers may reduce their spending or default on credit card payments, which can hurt Amex's revenue and profitability. Amex is facing increasing competition from fintech companies and mobile payment platforms like Google Pay and Apple Pay, which offer lower transaction fees and innovative services. Regulatory changes, particularly around fees, could also impact how Amex operates.

Investigate any legal or compliance issues

American Express has faced several legal and regulatory challenges, particularly over its merchant fees. In 2024, Amex was hit with a class-action lawsuit for allegedly overcharging merchants with excessive swipe fees. Merchants have long argued that Amex's high fees are unfair, leading some businesses like eBay (EBAY 2.16%) to stop accepting Amex cards altogether. These legal challenges could hurt Amex's reputation and force it to lower its fees, which would reduce a significant revenue stream.

Step 4: Place an order

Once your research is complete, place your order via your brokerage platform. There are a few different types of orders you can place. The main ones are listed below:

| Order Type | What it does |

|---|---|

| Market Order | Executed immediately at the current market price, ensuring the trade goes through as soon as possible. |

| Limit Order | Allows you to set a specific price limit; the order is only executed if the stock reaches that price or better, giving more control over the purchase price. |

| Stop Order | Once a predetermined price (the stop price) is reached, the order converts to a market order and is executed at the next available price, useful for limiting losses. |

| Stop-Limit Order | A hybrid of stop and limit orders. When the stop price is reached, the order becomes a limit order, meaning it will only be executed at the set limit price or better, offering precision and protection against volatility. |

Should I invest?

Should I invest in American Express?

Reasons you might want to consider investing in American Express (Amex):

You like to invest in companies with strong growth potential. American Express has consistently demonstrated strong revenue and profit growth, largely due to its global cardholder base and complex payment network rather than its banking services. The company expects revenue to grow between 9% and 11% annually over the next year or two, making it a stable investment for those seeking steady, long-term growth in the financial services sector.

Exclusive rewards and loyalty programs keep customers' loyalty. One of the best ways to determine if a company will grow in the future is how well it retains its customer base. Amex has some of the best rewards in the business, and they keep people coming back. Amex's strong rewards programs, particularly in travel and luxury spending, drive customer retention and high spending volume, which translates into revenue growth. With premium cards like a platinum card offering benefits such as 5% back on travel and access to airport lounges, Amex attracts affluent customers who tend to be loyal, and that supports its revenue. Many Amex platinum users continue to pay the high annual fees because of perks like travel credits, which can offset the cost.

Global reach means diversification in revenue streams. Amex has more than 144 million cards in circulation and is accepted at more than 80 million merchant locations worldwide. This is important because it diversifies risk outside of its U.S. market. Its business model of charging higher merchant fees across the board ensures strong profit margins, while its cardholder base provides a stable income stream.

Reasons why you might consider not investing in American Express

High merchant fees leading to limited acceptance. Unlike Visa and Mastercard, which charge lower fees, Amex's high transaction fees (as much as 3.5%) can limit its acceptance, particularly at small businesses. This can be frustrating for cardholders and may hurt wider market adoption in certain regions. Amex is less commonly accepted in some areas of Europe, particularly in smaller establishments or restaurants that favor Visa and Mastercard due to their lower fees. Travelers in regions like Vietnam or some European countries may find Amex accepted at larger shopping centers and chain restaurants but not at smaller businesses.

Vulnerability to economic downturns. Amex is highly dependent on consumer spending, particularly in travel and luxury categories. In economic downturns or periods of lower consumer confidence, spending on credit cards tends to decline, which can hurt the company's earnings. During the 2008 financial crisis, Amex experienced significant losses as cardholders defaulted on payments and reduced spending.

You think competition and change might dilute the payment market. The entry of technology into the payments space is resulting in more competition, meaning the market could become diluted. The rise of digital wallets and mobile payment platforms like Apple Pay, Google Pay, and WeChat is challenging traditional credit card models, including Amex. There are even rumors of X (formerly known as Twitter) getting involved in the payment space, with court documents showing there have been applications filed. These platforms offer lower fees and more convenience, particularly among younger generations, which may erode Amex's market share over time.

Profitability

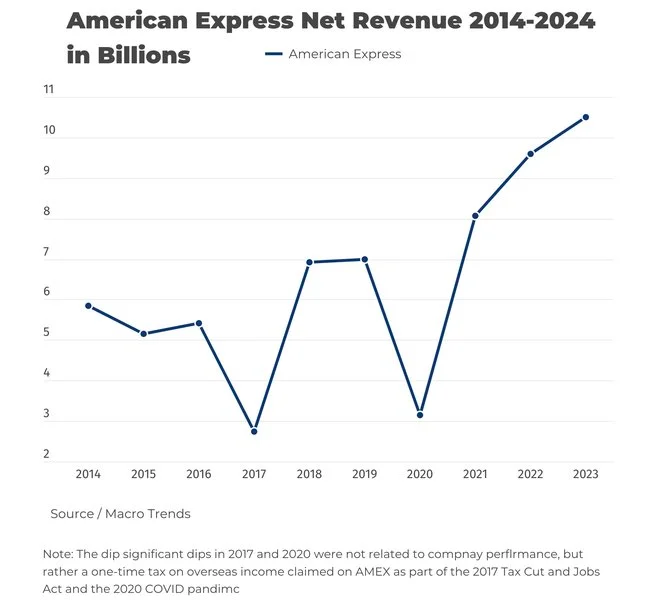

Is American Express profitable?

American Express is profitable. In recent financial reports, the company has consistently demonstrated robust earnings. For the current fiscal year, American Express anticipates continued revenue growth of 9% to 11%. With a large and extremely loyal customer base, particularly with premium cardholders, Amex maintains quite a good financial position, driven by transaction fees, interest income, and its expanding global reach.

Dividends

Does American Express pay a dividend?

American Express pays a dividend. The company has a dividend yield of 1.14% as of the latest year, with an annual dividend payout of $2.80 per share. This year, Amex is expected to pay out $1.99 billion in dividends, continuing its long history of increasing payouts to shareholders.

Exchange-Traded Fund (ETF)

ETFs

What ETFs have exposure to American Express?

There are several ETFs with exposure to American Express that are tracking electronic and mobile payments stocks rather than bank ETFs, and some that are tracking a basic portfolio of stocks on an index that contains American Express. Here are a few:

|

ETF ticker |

ETF name | Exposure to AXP | Assets under management | Expense ratio |

|---|---|---|---|---|

| (NYSEMKT:SPY) | SPDR S&P 500 ETF | 0.60% | $422B | 0.09% |

| (NYSEMKT:IVV) | iShares Core S&P 500 ETF | 0.61% | $383.3B | 0.03% |

| (NYSEMKT:JRNY) | ALPS Global Travel Beneficiaries ETF | 5.38% | $5.8M | 0.65% |

| (NYSEMKT:TGLR) | LAFFER TENGLER Equity Income ETF | 4.62% | $12.9M | 0.95% |

| (NYSEMKT:VTI) | Vanguard Total Stock Market ETF | 0.41% | $308.8B | 0.03% |

Stock splits

Will American Express stock split?

As of now, there is no official announcement from American Express regarding a stock split. The company's last stock split happened in 2005. Stock splits usually occur when a company's share price has risen to a point where they want to make it more affordable and accessible to more investors.

Currently, American Express is focusing on its growth strategy, with expectations of a 9% to 11% revenue increase and a 19% to 23% rise in earnings per share (EPS). This generally means that the company is performing well, prioritizing its financial growth and continued growth will fuel speculation of a possible stock split. However, without an official statement, it's just speculation whether they will decide to split their stock anytime soon.

Related investing topics

The bottom line on American Express

American Express is a blue chip stock, and bank stocks are safe, although this isn't considered a traditional bank stock. With that comes low volatility, but not a knock-you-out-of-this-park upside. That being said, it's a great one for the portfolio because it experiences stable year-over-year growth, and pays a dividend, which is great for the income-focused investor. American Express should be a consideration for anyone with a long-term horizon, but the company's finances should be reviewed by investors on a regular basis.

FAQ

FAQ

Can you invest in American Express?

Yes, you can definitely invest in American Express! It's a publicly traded company, so you can buy its stock just like you would with any other company listed on the stock market. All you need is a brokerage account, and you can purchase shares of American Express using its ticker symbol.

Is American Express a good stock to buy?

Whether American Express is a good stock to buy depends on a few things, like your investment goals, risk tolerance, and market conditions. Historically, it's been a strong performer, with steady revenue and earnings growth. It has a solid business model, especially with its focus on high-spending consumers and businesses.

Does Warren Buffett invest in American Express?

Warren Buffett does invest in American Express; it's one of his favorite long-term holdings. His company, Berkshire Hathaway, has owned a significant stake in American Express for many years. Buffett likes businesses with strong brands and loyal customers, and American Express fits that bill perfectly. His confidence in the company is often seen as a good sign.

What is the ticker for American Express?

The ticker symbol for American Express is AXP. You can use this ticker to look up the stock on financial websites or your brokerage platform if you're interested in following its performance or investing in it.