With its portfolio of industry-leading brands, Stellantis (STLA 3.75%) is an international automotive powerhouse, so it's understandable that car stock enthusiasts are consistently drawn to Stellantis. Stellantis is a corporation with a considerable global presence. It's the parent company of famous American brands like Jeep, Chrysler, and Dodge; well-known French names like Citroen and Peugeot; and legendary Italian brands like Alfa Romeo and Maserati.

While you may recognize the names in the Stellantis portfolio, you may be less familiar with the corporation itself. Stellantis was formed after a merger between Fiat Chrysler Automobiles (FCA) and French carmaker PSA and started operating in its current iteration in 2021. But many of its brands have far longer histories.

Besides the traditional internal combustion engine vehicles that Stellantis produces, the company is committed to offering an increasing number of electric vehicles (EVs) as well. When 2023 ended, about one-third of the vehicles in the company's portfolio were battery-electric. The company expects to introduce another 18 battery EVs in 2024, making the company a worthy consideration for those interested in electric car stocks.

Although manufacturing motor vehicles is the company's main business, it's also a notable investor in Archer Aviation (ACHR -0.52%), a company dedicated to providing customers with a novel option to travel in urban settings on its electric vertical takeoff and landing aircraft. In January 2023, Stellantis inked an agreement with Archer to manufacture the company's Midnight aircraft. In addition, Stellantis provided up to $150 million in equity capital for Archer to access as it sees fit in 2023 and 2024.

Moreover, Stellantis announced in March 2024 that it had completed a series of purchases of Archer stock on the open market that totaled about 8.3 million shares. Since first investing in Archer in 2021, Stellantis has grown its ownership position in Archer significantly. As of June 2024, Stellantis owned about 16% of Archer Aviation's outstanding shares.

How to invest

How to buy Stellantis stock

Before you can hitch a ride with Stellantis as an investor, there are some basic steps you need to take to buy stocks.

Step 1: Open a brokerage account

Before buying Stellantis stock -- or any stock for that matter -- you must first open a brokerage account. It doesn't take long to complete the process. Once you're done, you'll be able to buy stocks as well as other investment assets.

Step 2: Figure out your budget

Everyone's financial situation is unique. Consider yours carefully. Determine how much capital you can allocate for investing. Be mindful of also establishing an emergency fund and accounting for household expenses.

Step 3: Do your research

Smart investors know the importance of performing their due diligence before buying any given stock. If you're interested in Stellantis, for example, this means investigating other automotive stocks. After doing your research, make sure you're confident that Stellantis is an appropriate choice.

Step 4: Place an order

You're nearly there. Soon, you will have a new auto stock in your portfolio. After entering the stock's ticker (STLA for Stellantis) and choosing to buy the stock (instead of sell), you must decide whether you're making a market order or a limit order. Also, you'll have to determine the size of your purchase -- whether it's one share or many more.

Should I invest

Should I invest in Stellantis?

Every individual has a unique investing perspective and financial situation. That being said, there are several reasons investors may or may not find Stellantis stock appealing.

One of the most obvious questions to consider is whether you're interested in a consumer durables stock like Stellantis. Conservative investors or those with shorter investing horizons, for instance, may be less interested in an automaker. Consumer durable stocks tend to be cyclical, so those who aren't comfortable holding Stellantis through downturns should look elsewhere.

Another important question is whether you're looking to supplement your passive income. If you're looking for an interesting high-yield dividend stock, Stellantis is worth further investigation -- especially since management seems focused on ensuring that the company's financial security won't be jeopardized by a high payout.

Of course, it's not only auto investors who will find Stellantis stock alluring. With the sizable position that Stellantis owns in Archer, investors can gain indirect exposure to Archer stock by picking up shares of Stellantis. The fact that Stellantis has signed an agreement to manufacture Archer's aircraft means even more exposure to Archer.

Lastly, if you're interested in an automaker that's embracing the transition to EVs, it's worth considering Stellantis stock in addition to EV pure-plays like Tesla (TSLA 0.15%) and Rivian (RIVN -4.7%). Though Stellantis still sells internal combustion engine vehicles, it's expanding its lineup of EVs in the coming year. And while the company may represent less of a growth opportunity than Tesla and Rivian, the company still stands to benefit from the growing demand for EVs worldwide.

Profitability

Is Stellantis profitable?

Over the past three years, Stellantis has increased profits. After reporting diluted earnings per share (EPS) of 4.51 euros in 2021, the automaker reported diluted EPS of 5.31 euros and 5.94 euros in 2022 and 2023, respectively.

One of the primary drivers for the company's increasing profits is its strong performance from its combined operations in South America, Africa, and China -- a segment that the company calls 3rd Engine. Since 2020 (on a pro forma basis), when it accounted for revenue of 14.2 billion euros, 3rd Engine sales had grown at a compound annual growth rate of 28% through 2023 when it represented sales of 30.1 billion euros. Regarding profitability, 3rd Engine has soared from representing 5% of the company's adjusted operating income in 2020 (on a pro forma basis) to 22% in 2023.

Dividends

Does Stellantis pay a dividend?

Stellantis has rewarded investors with a dividend since the merger between FCA and PSA. In 2022 and 2023, for example, Stellantis paid dividends per share of 1.04 euros (about $1.13) and 1.34 euros (about $1.46), respectively. For 2024, the company returned 1.55 euros per share (approximately $1.65) to investors.

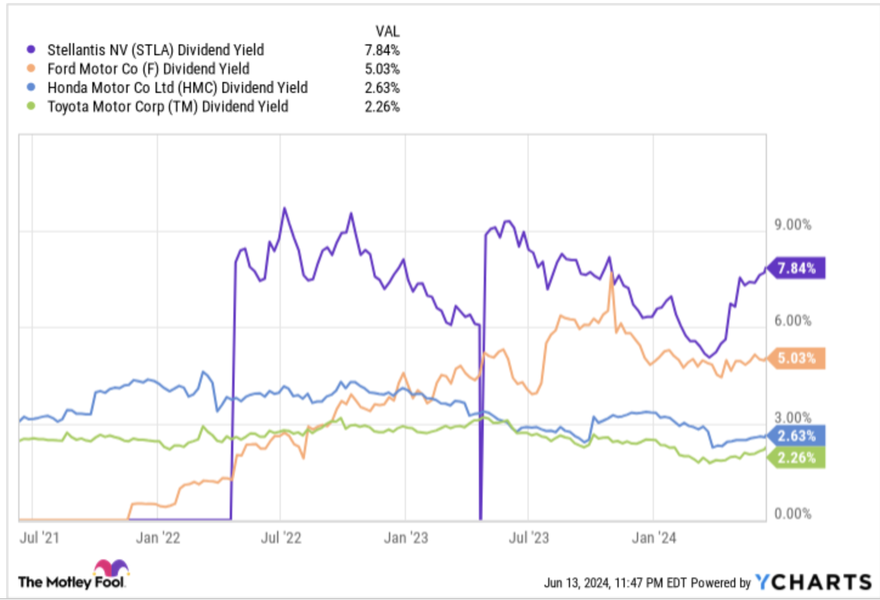

Stellantis has one of the highest dividend yields among automakers, with a yield of about 8% based on its share price as of June 2024. That's a significantly higher yield than peers like Ford (F 0.41%), Honda Motor (HMC 3.94%), and Toyota Motor (TM -2.49%) currently pay.

Lest investors fret that the high dividend yield portends poor financial health, the company has articulated a dividend policy that targets a payout ratio between 25% and 30%. Consistent with this, the company's current payout ratio is 23%.

ETFs

ETFs with exposure to Stellantis

If you want broad EV exposure, an exchange-traded fund (ETF) that includes Stellantis among its holdings is a great choice. Unfortunately, there aren't many choices out there.

One option, though, is the Global X Autonomous & Electric Vehicles ETF (NYSEMKT:DRIV). Committed to stocks that provide exposure to autonomous vehicles as well as EVs, the Global X Autonomous & Electric Vehicles ETF has 75 holdings. Stellantis is among the fund's top 25 holdings with a 1.35% weighting. The ETF has a total expense ratio of 0.68%, meaning $6.80 of a $1,000 investment goes toward fees.

If you're more interested in Stellantis as a potential source of passive income and care less about EV exposure, the WisdomTree Global High Dividend Fund (DEW -0.18%) is worth consideration. Focusing on large-cap, worldwide companies that offer high dividend yields, the fund has 658 holdings, with Stellantis occupying the 38th largest position. The ETF has a 0.58% expense ratio, which amounts to $5.80 in fees on a $1,000 investment.

Stock splits

Will Stellantis stock split?

Since the completion of the merger in 2021 that created Stellantis as it is today, the company has not split its stock, and there's no indication that it intends to split it anytime soon. Given that many brokers now offer fractional shares of stocks, fewer companies seem inclined to offer stock splits.

Although there are many stocks that split in 2023 and some that are scheduled to split in 2024, it's unlikely that Stellantis management will announce an upcoming split in the near future.

Related investing topics

The bottom line on Stellantis

Since the completion of the FCA and PSA merger, shares of Stellantis have failed to keep pace with the S&P 500 index. But it's important to remember that the company has operated in its post-merger form for just over three years. It's quite possible that this leading global automaker will be a long-term winner for investors.

Whether you're interested in gaining EV exposure or boosting your passive income -- or another goal altogether -- Stellantis could be a good choice to park in your portfolio.

FAQ

Investing in Stellantis FAQ

Can you buy stock in Stellantis?

Yes, Stellantis is a publicly traded stock that trades on the New York Stock Exchange. Investors can buy the stock using a brokerage account.

Is Stellantis a good stock to invest in?

Since each investor's financial situation is unique, it's impossible to say for certain whether Stellantis is a good stock to buy. Individuals should do their due diligence and then decide if Stellantis is a good stock for them.

Is Stellantis a good dividend stock?

Although it has a short history of paying dividends, Stellantis seems like an attractive option considering its high yield and low payout ratio.

Does Stellantis pay dividends?

Stellantis has paid dividends for the past three years, and management seems intent on continuing to reward shareholders with dividends as long as the company remains profitable.